CVX Weekly Technical Analysis

Chevron Corporation

Integrated energy and chemical company

CVX Technical Analysis Summary

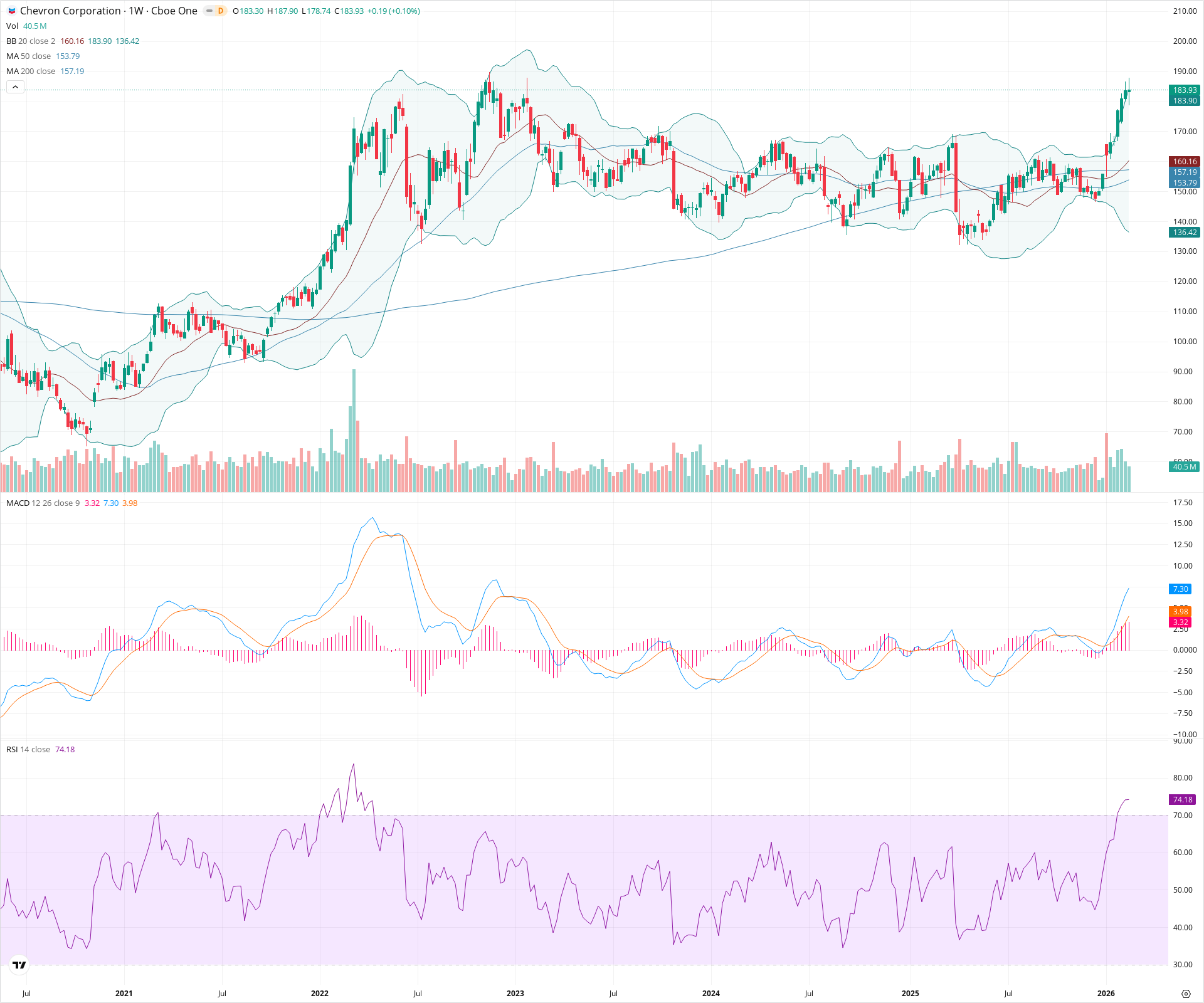

CVX has staged a significant technical breakout, clearing a massive multi-year consolidation base that capped the stock around the 170-175 level. The current price action is strongly bullish across multiple timeframes, confirmed by expanding MACD and price riding the upper Bollinger Band. While short-term overbought RSI readings suggest a minor pause or retest of the breakout zone is possible, the broader structural trend heavily favors continued upside as it tests historical highs near 190.

Included In Lists

Related Tickers of Interest

CVX Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is demonstrating strong upward momentum, riding the upper Bollinger Band with a sharply rising 20-week SMA. MACD is positive and expanding, confirming the recent breakout. While RSI is overbought (>70), this currently reflects strong trend momentum rather than immediate reversal.

Long-term Sentiment (weeks to months): Bullish

The stock has successfully broken out of a massive multi-year consolidation base. Price is positioned well above the 50-week and 200-week SMAs, signaling a resumption of the primary long-term uptrend.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:39:10.437Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $172.50 | $170.00 - $175.00 | Strong | Previous major resistance zone of the multi-year consolidation pattern. Now expected to act as strong support upon any pullback (breakout retest). |

| $157.50 | $155.00 - $160.00 | Strong | Confluence zone of the 20-week, 50-week, and 200-week Simple Moving Averages, representing the core value area of the previous trading range. |

| $138.00 | $136.00 - $140.00 | Strong | Major structural swing lows that defined the bottom of the prolonged consolidation phase. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $187.50 | $185.00 - $190.00 | Strong | The previous all-time high resistance zone established in late 2022 and early 2023. Price is currently testing the lower bounds of this area. |

| $202.50 | $200.00 - $205.00 | Weak | Psychological round number resistance and a potential measured move target if the current breakout sustains. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Multi-year Range Breakout | Bullish | N/A | Price consolidated in a wide, choppy range roughly between 140 and 175 for over a year and a half before decisively breaking upward. |

Frequently Asked Questions about CVX

What is the current sentiment for CVX?

The short-term sentiment for CVX is currently Bullish because Price is demonstrating strong upward momentum, riding the upper Bollinger Band with a sharply rising 20-week SMA. MACD is positive and expanding, confirming the recent breakout. While RSI is overbought (>70), this currently reflects strong trend momentum rather than immediate reversal.. The long-term trend is classified as Bullish.

What are the key support levels for CVX?

StockDips.AI has identified key support levels for CVX at $172.50 and $157.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is CVX in a significant dip or a Value Dip right now?

CVX has a Value Score of 52/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.