JPM Daily Technical Analysis

JPMorgan Chase & Co.

Largest U.S. bank providing consumer, corporate, and investment banking services.

JPM Technical Analysis Summary

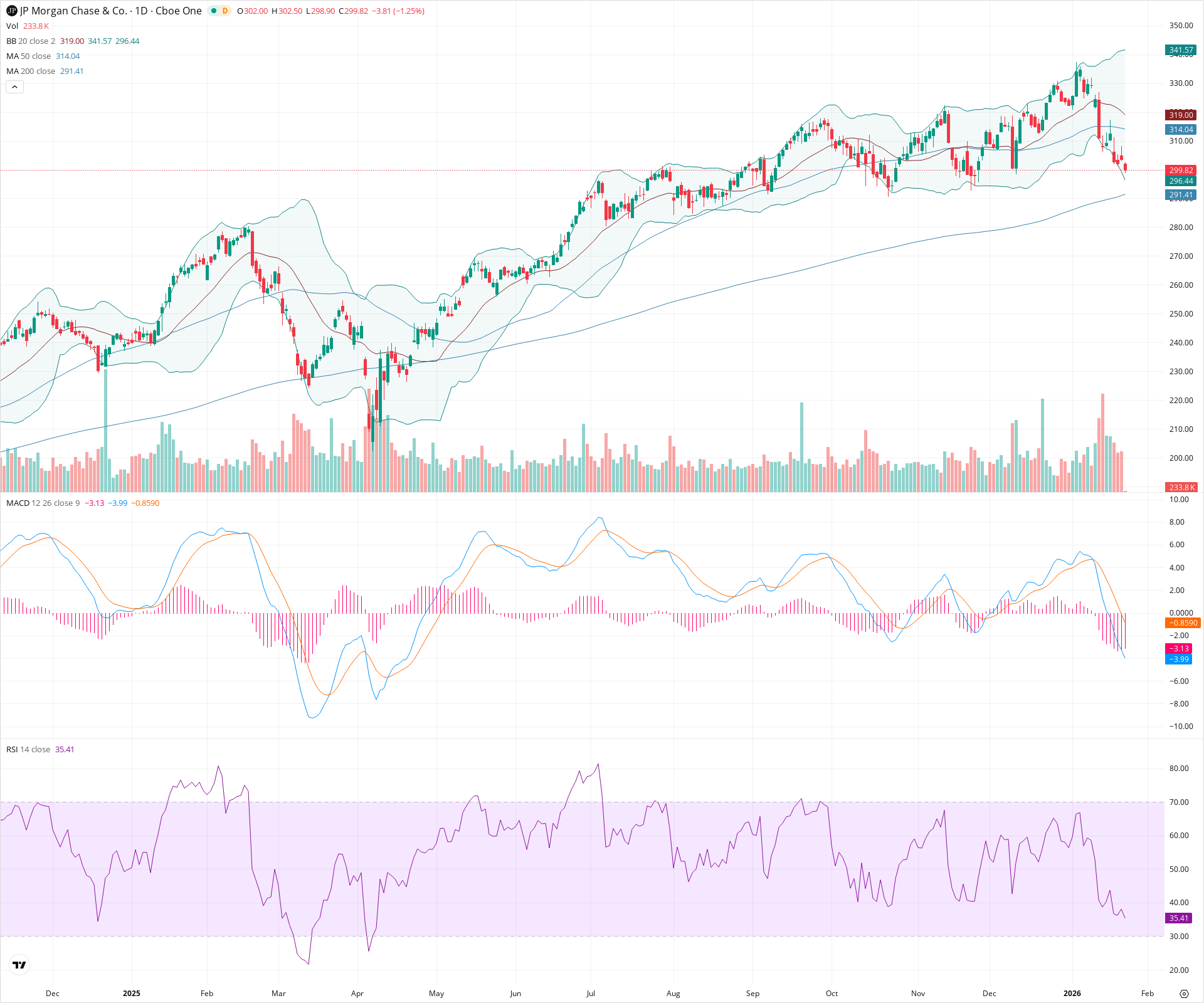

JPM is experiencing a sharp short-term correction, having broken key intermediate support levels at the 20-day and 50-day SMAs. Bearish momentum is confirmed by the MACD histogram and falling RSI, suggesting the price may test the major support at the rising 200-day SMA near 291.41. While the immediate outlook is negative, the long-term bullish trend remains technically valid as long as the price holds above the 200-day average.

Included In Lists

Related Tickers of Interest

JPM Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price has sharply declined below the 20-day and 50-day SMAs, RSI is falling towards oversold territory, and MACD shows a strong bearish crossover with expanding negative histogram.

Long-term Sentiment (weeks to months): Bullish

Despite the recent pullback, the price remains above the rising 200-day SMA (291.41), keeping the primary long-term uptrend structure intact for now.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:03:42.919Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $296.47 | $296.44 - $296.50 | Weak | Immediate support at the Lower Bollinger Band, which is currently being tested. |

| $291.46 | $291.41 - $291.50 | Strong | The 200-day SMA acts as the critical dynamic support level for the long-term trend. |

| $277.50 | $275.00 - $280.00 | Strong | Previous consolidation zone and swing lows visible from late 2025. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $316.52 | $314.04 - $319.00 | Strong | Confluence of the 50-day SMA and the 20-day SMA (Bollinger Middle Band), which recently acted as support but will now serve as resistance. |

| $343.28 | $341.57 - $345.00 | Strong | Recent swing highs and the current level of the Upper Bollinger Band. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bearish Breakout | Bearish | $291.41 | Price has closed below the 50-day SMA with increasing downside momentum, confirmed by MACD. |

| Weak | Trend Pullback | Neutral | N/A | The current decline represents a significant correction within the broader uptrend, approaching the 200-day mean reversion point. |

Frequently Asked Questions about JPM

What is the current sentiment for JPM?

The short-term sentiment for JPM is currently Bearish because Price has sharply declined below the 20-day and 50-day SMAs, RSI is falling towards oversold territory, and MACD shows a strong bearish crossover with expanding negative histogram.. The long-term trend is classified as Bullish.

What are the key support levels for JPM?

StockDips.AI has identified key support levels for JPM at $296.47 and $291.46. These levels may represent potential accumulation zones where buying interest could emerge.

Is JPM in a significant dip or a Value Dip right now?

JPM has a Value Score of 97/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.