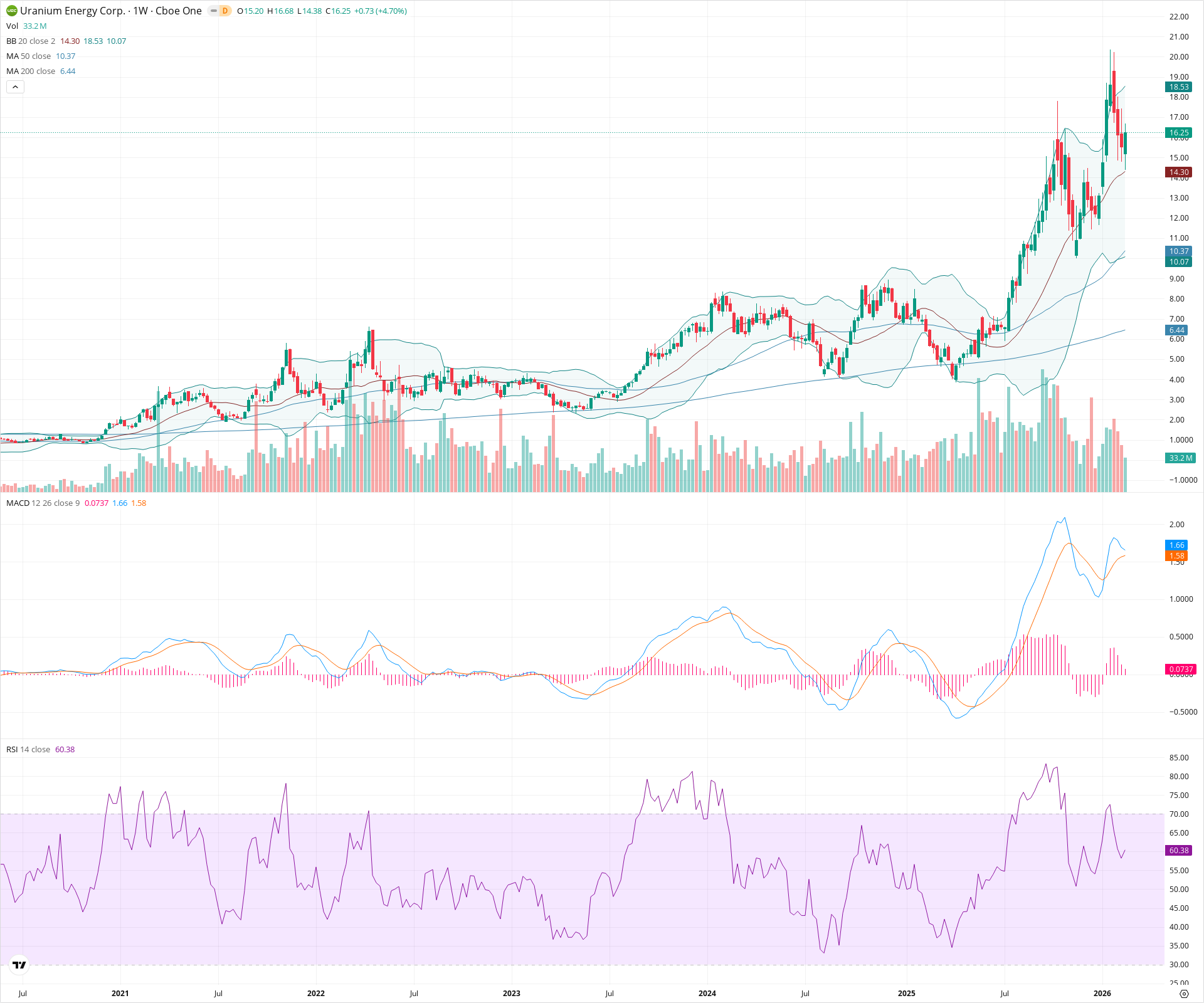

UEC Weekly Technical Analysis

Uranium Energy Corp

Uranium mining and exploration company positioned to benefit from rising nuclear fuel demand.

UEC Technical Analysis Summary

UEC is exhibiting a classic strong long-term uptrend on the weekly timeframe, supported by rising long-term moving averages. The recent price action represents a healthy consolidation phase following a sharp rally, allowing momentum indicators to reset from overbought conditions. As long as the stock maintains structural support above the 14.00 and ultimately the 10.00 levels, the broader technical posture remains favorable for higher prices.

Included In Lists

Related Tickers of Interest

UEC Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is consolidating after a significant rally, pulling back to the 20-week moving average. Short-term momentum indicators have cooled, with the MACD histogram turning negative, suggesting a pause in the immediate uptrend.

Long-term Sentiment (weeks to months): Bullish

The stock remains in a strong multi-year uptrend characterized by higher highs and higher lows. Price is comfortably above both the upward-sloping 50-week and 200-week moving averages, indicating robust long-term bullish market structure.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:38:20.729Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $14.25 | $14.00 - $14.50 | Strong | Current consolidation support zone, aligning closely with the 20-week simple moving average (middle Bollinger Band). |

| $10.25 | $10.00 - $10.50 | Strong | Major structural support zone. This area represents a prior multi-month consolidation breakout level and aligns with the rising 50-week moving average. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $19.00 | $18.50 - $19.50 | Strong | Recent major swing highs and the upper boundary of the current consolidation phase. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bullish Consolidation | Bullish | N/A | Following a steep vertical advance, the price is currently forming a multi-week consolidation pattern (potentially a flag or high base), absorbing supply while holding key short-term moving average support. |

Frequently Asked Questions about UEC

What is the current sentiment for UEC?

The short-term sentiment for UEC is currently Neutral because Price is consolidating after a significant rally, pulling back to the 20-week moving average. Short-term momentum indicators have cooled, with the MACD histogram turning negative, suggesting a pause in the immediate uptrend.. The long-term trend is classified as Bullish.

What are the key support levels for UEC?

StockDips.AI has identified key support levels for UEC at $14.25 and $10.25. These levels may represent potential accumulation zones where buying interest could emerge.

Is UEC in a significant dip or a Value Dip right now?

UEC has a Value Score of 47/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.