MA Daily Technical Analysis

Mastercard Inc

A global financial services company that provides a wide range of payment choices and processes transactions for credit and debit cards, electronic cash, and ATMs.

MA Technical Analysis Summary

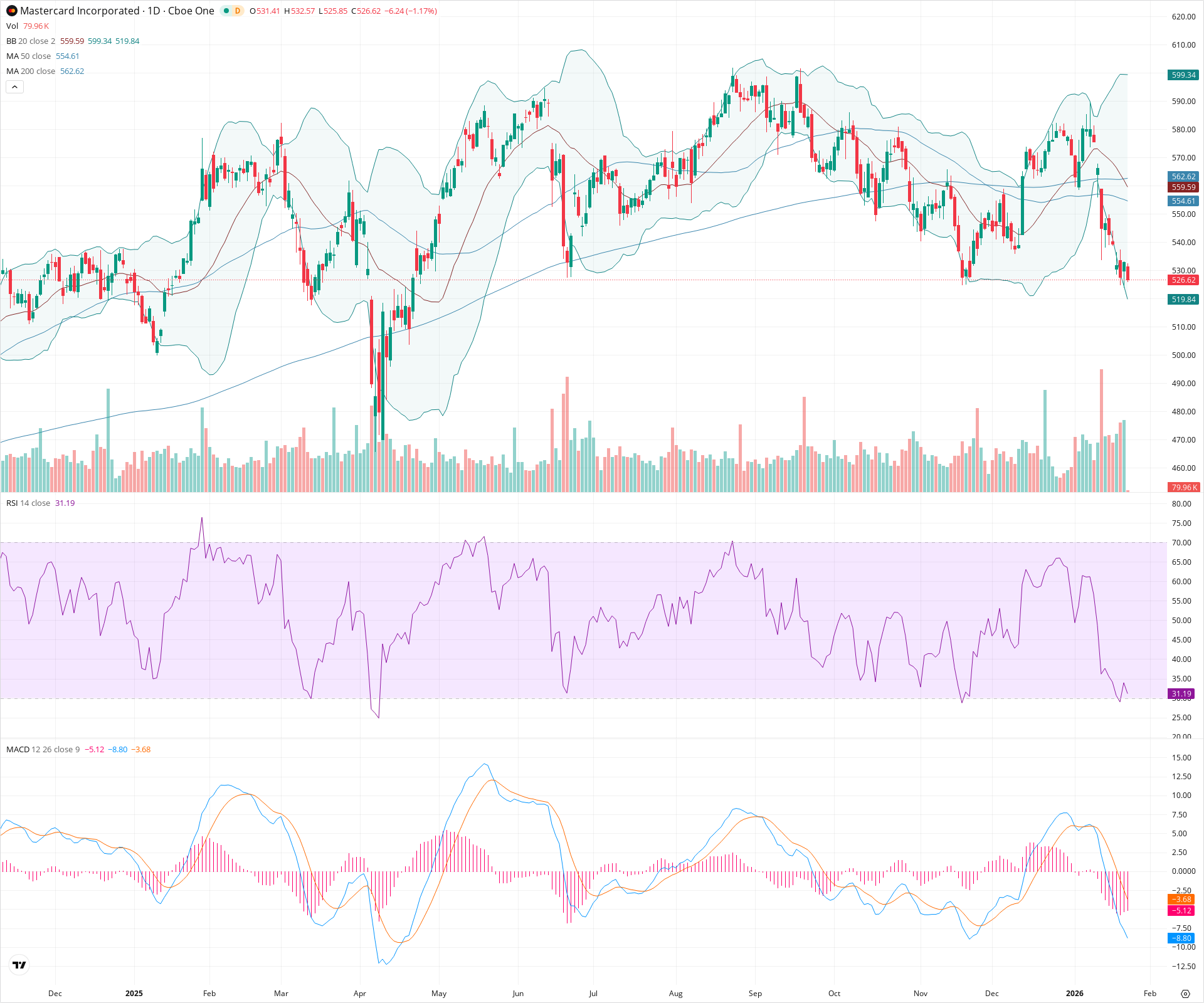

Mastercard (MA) is undergoing a significant correction, having broken below its 20-day and 50-day moving averages on continued selling volume. The stock is currently testing a critical long-term support zone around 515-520, which aligns with the 200-day SMA and the lower Bollinger Band. Technical indicators like the MACD and RSI remain bearish, suggesting that while the asset is approaching oversold territory, the downward momentum has not yet abated.

Included In Lists

Related Tickers of Interest

MA Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price is trading sharply below the 20-day and 50-day SMAs. Momentum is strongly negative as indicated by the MACD expanding downwards and the price riding the lower Bollinger Band. RSI is at 31.19, bordering on oversold but showing no divergence or reversal signs yet.

Long-term Sentiment (weeks to months): Neutral

The long-term uptrend is under threat as price pulls back deeply to test the 200-day SMA (dark blue line) acting as dynamic support. While the 50-day SMA is still visually above the 200-day (Golden Cross structure), the loss of the 50-day SMA and the steep correction suggest a potential trend shift if the 200-day support fails.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:06:56.287Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $517.50 | $515.00 - $520.00 | Strong | Confluence of the 200-day SMA, the lower Bollinger Band, and recent swing lows from late 2025. |

| $495.00 | $490.00 - $500.00 | Weak | Psychological round number and historical consolidation zone from mid-2025. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $557.00 | $554.00 - $560.00 | Strong | Cluster of moving averages (50-day and 20-day SMAs) and the breakdown level from the recent top. |

| $595.00 | $590.00 - $600.00 | Strong | Recent swing highs forming a potential double top structure. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Correction / Pullback | Bearish | $515.00 | A sharp decline from recent highs, breaking short-term trend supports. |

| Weak | Double Top (Potential) | Bearish | N/A | Two peaks around the 590-600 level followed by a break of the neckline, signaling a trend reversal. |

Frequently Asked Questions about MA

What is the current sentiment for MA?

The short-term sentiment for MA is currently Bearish because Price is trading sharply below the 20-day and 50-day SMAs. Momentum is strongly negative as indicated by the MACD expanding downwards and the price riding the lower Bollinger Band. RSI is at 31.19, bordering on oversold but showing no divergence or reversal signs yet.. The long-term trend is classified as Neutral.

What are the key support levels for MA?

StockDips.AI has identified key support levels for MA at $517.50 and $495.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is MA in a significant dip or a Value Dip right now?

MA has a Value Score of 79/100. It is currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.