V Daily Technical Analysis

Visa

World’s leading digital payments network enabling global card transactions.

V Technical Analysis Summary

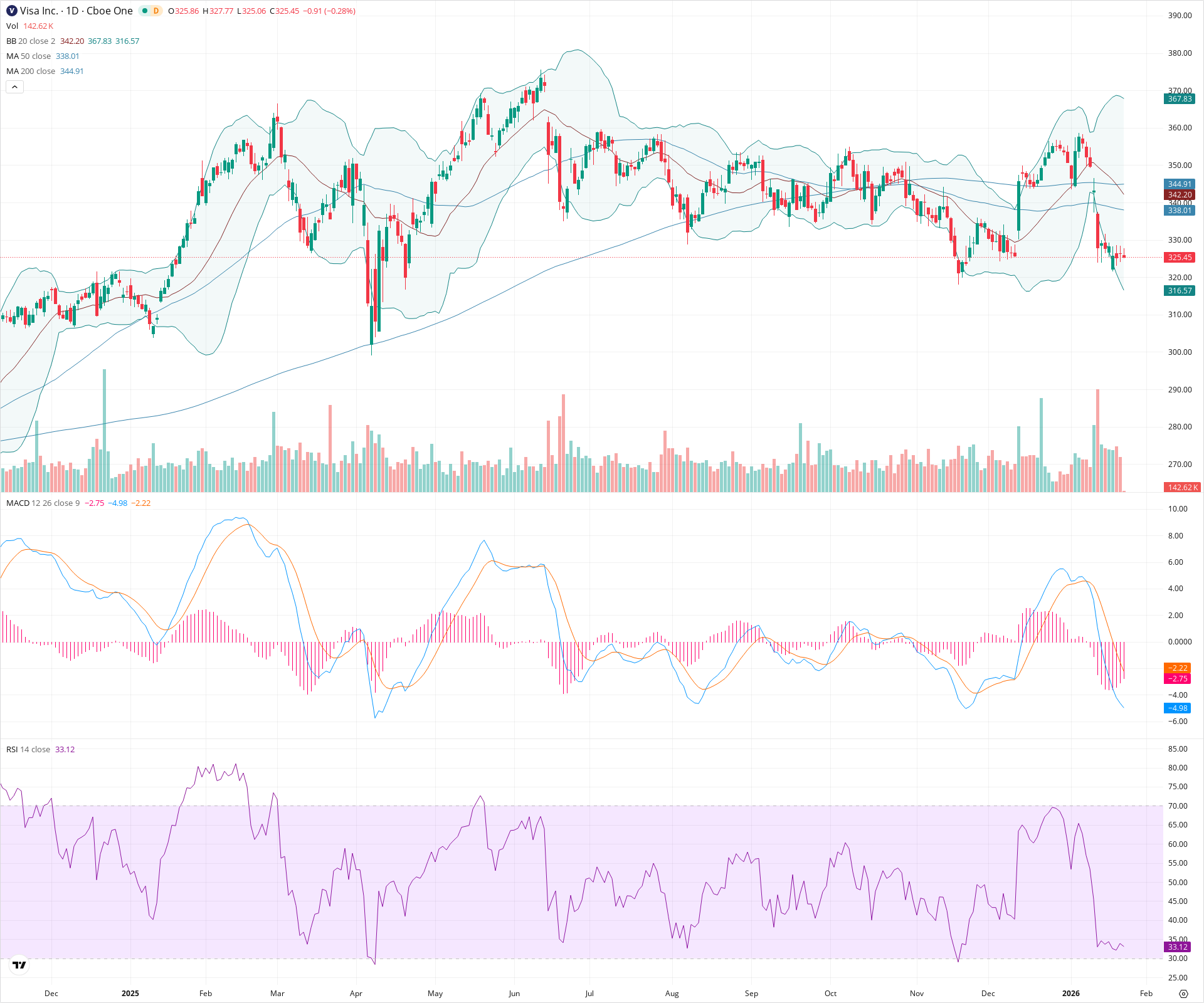

Visa Inc. is showing a deteriorating technical picture with the price falling below all major moving averages, confirmed by a bearish 'Death Cross' between the 50 and 200 SMAs. Momentum is strongly negative with the MACD histogram expanding downwards, though the RSI approaching 30 suggests the sell-off may be nearing a short-term oversold condition. The stock is approaching a critical support zone around 315-318 which must hold to prevent a deeper correction toward 300.

Included In Lists

Related Tickers of Interest

V Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price is trading well below the 20-day SMA and riding the lower Bollinger Band. The RSI is trending down at 33.12, and the MACD shows expanding negative momentum.

Long-term Sentiment (weeks to months): Bearish

The stock is trading below the 200-day SMA (344.91), and the 50-day SMA (338.01) has crossed below the 200-day SMA, forming a bearish 'Death Cross'.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:05:51.278Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $316.50 | $315.00 - $318.00 | Strong | Key swing lows from August and October/November acting as the next major floor. |

| $302.50 | $300.00 - $305.00 | Strong | Major structural support zone established around the April lows. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $341.50 | $338.00 - $345.00 | Strong | Confluence of the 50-day SMA, 200-day SMA, and 20-day SMA creating a heavy overhead resistance zone. |

| $357.50 | $355.00 - $360.00 | Weak | Recent swing high area before the latest breakdown. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Death Cross | Bearish | N/A | The 50-day SMA (338.01) has crossed below the 200-day SMA (344.91), signaling a potential long-term trend reversal to the downside. |

| Strong | Lower Highs and Lows | Bearish | $315.00 | Since the peak near 367, the price action has formed a sequence of lower swing highs and lower lows, defining a downtrend. |

Frequently Asked Questions about V

What is the current sentiment for V?

The short-term sentiment for V is currently Bearish because Price is trading well below the 20-day SMA and riding the lower Bollinger Band. The RSI is trending down at 33.12, and the MACD shows expanding negative momentum.. The long-term trend is classified as Bearish.

What are the key support levels for V?

StockDips.AI has identified key support levels for V at $316.50 and $302.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is V in a significant dip or a Value Dip right now?

V has a Value Score of 58/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.