MELI Daily Technical Analysis

MercadoLibre Inc

Latin America's leading e-commerce and digital payments company.

MELI Technical Analysis Summary

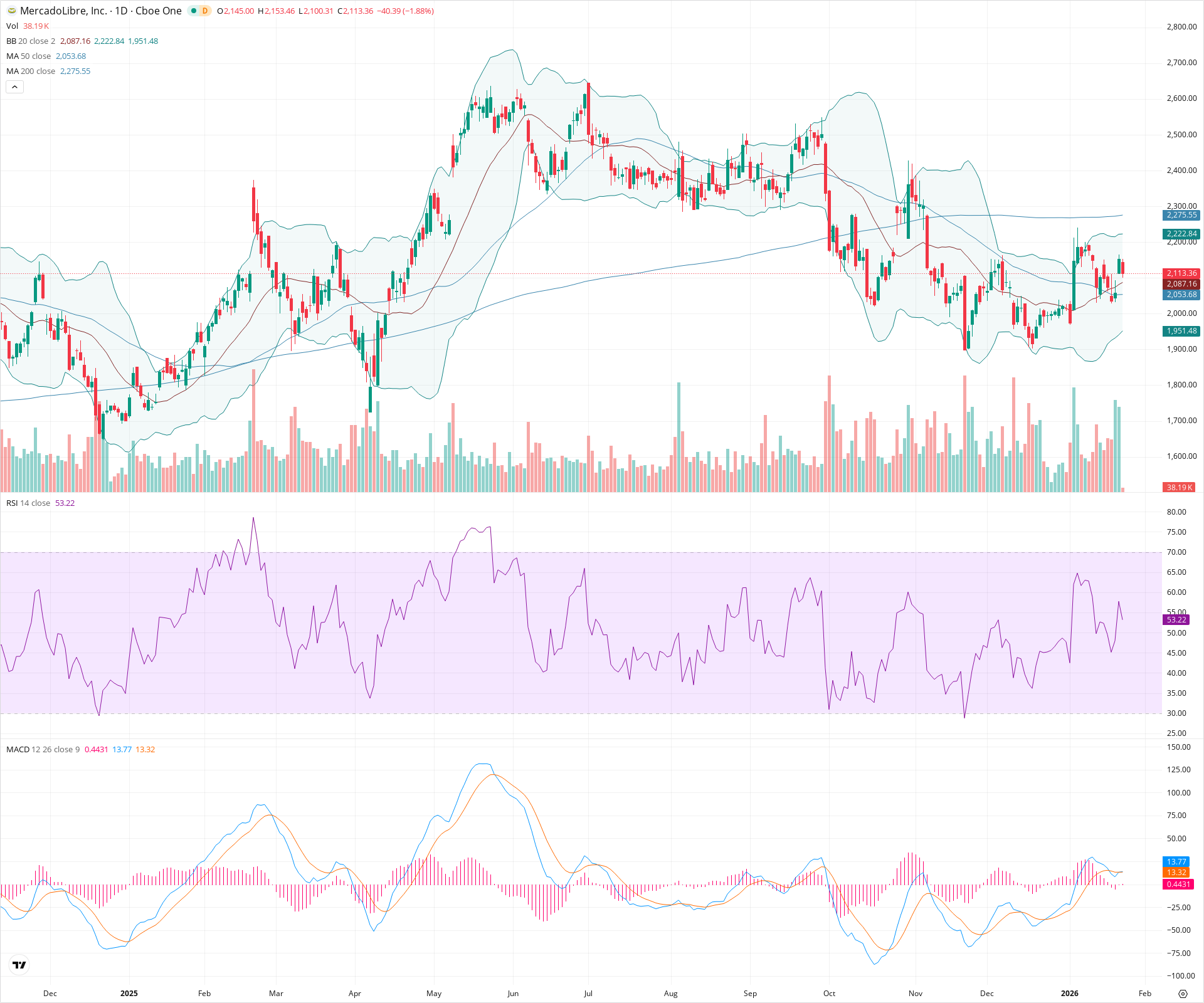

MercadoLibre is currently navigating a consolidation zone, trading above its short-term moving averages (20 and 50 SMAs) but remaining capped by the long-term 200-day SMA overhead. The recent price action shows a recovery attempt from the 1900 level, supported by a bullish MACD crossover, though momentum is facing resistance near the upper Bollinger Band at 2222. A decisive break above the 200-day SMA is required to confirm a long-term trend reversal, while holding the 2053 support level is critical for the short-term bullish thesis.

Included In Lists

Related Tickers of Interest

MELI Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is trading above both the 20-day and 50-day SMAs, showing a recovery trend from recent lows. The MACD has recently executed a bullish crossover with rising lines.

Long-term Sentiment (weeks to months): Bearish

The stock remains below the declining 200-day SMA, indicating the primary long-term trend is still downward despite recent stabilization.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:10:19.776Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $2,070.42 | $2,053.68 - $2,087.16 | Strong | Confluence of the 50-day SMA and the 20-day SMA (Bollinger Band midline). |

| $1,955.74 | $1,951.48 - $1,960.00 | Strong | Recent swing lows and proximity to the Lower Bollinger Band. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $2,211.42 | $2,200.00 - $2,222.84 | Strong | Recent swing high rejection zone and Upper Bollinger Band. |

| $2,287.78 | $2,275.55 - $2,300.00 | Strong | The 200-day SMA acts as major dynamic resistance. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Weak | Base Formation | Neutral | N/A | Price has been consolidating between 1900 and 2200 since late 2024, attempting to carve out a bottom. |

Frequently Asked Questions about MELI

What is the current sentiment for MELI?

The short-term sentiment for MELI is currently Bullish because Price is trading above both the 20-day and 50-day SMAs, showing a recovery trend from recent lows. The MACD has recently executed a bullish crossover with rising lines.. The long-term trend is classified as Bearish.

What are the key support levels for MELI?

StockDips.AI has identified key support levels for MELI at $2,070.42 and $1,955.74. These levels may represent potential accumulation zones where buying interest could emerge.

Is MELI in a significant dip or a Value Dip right now?

MELI has a Value Score of 56/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.