META Daily Technical Analysis

Meta Platforms Inc

Owner of Facebook, Instagram, and WhatsApp with investment in AI and virtual reality.

META Technical Analysis Summary

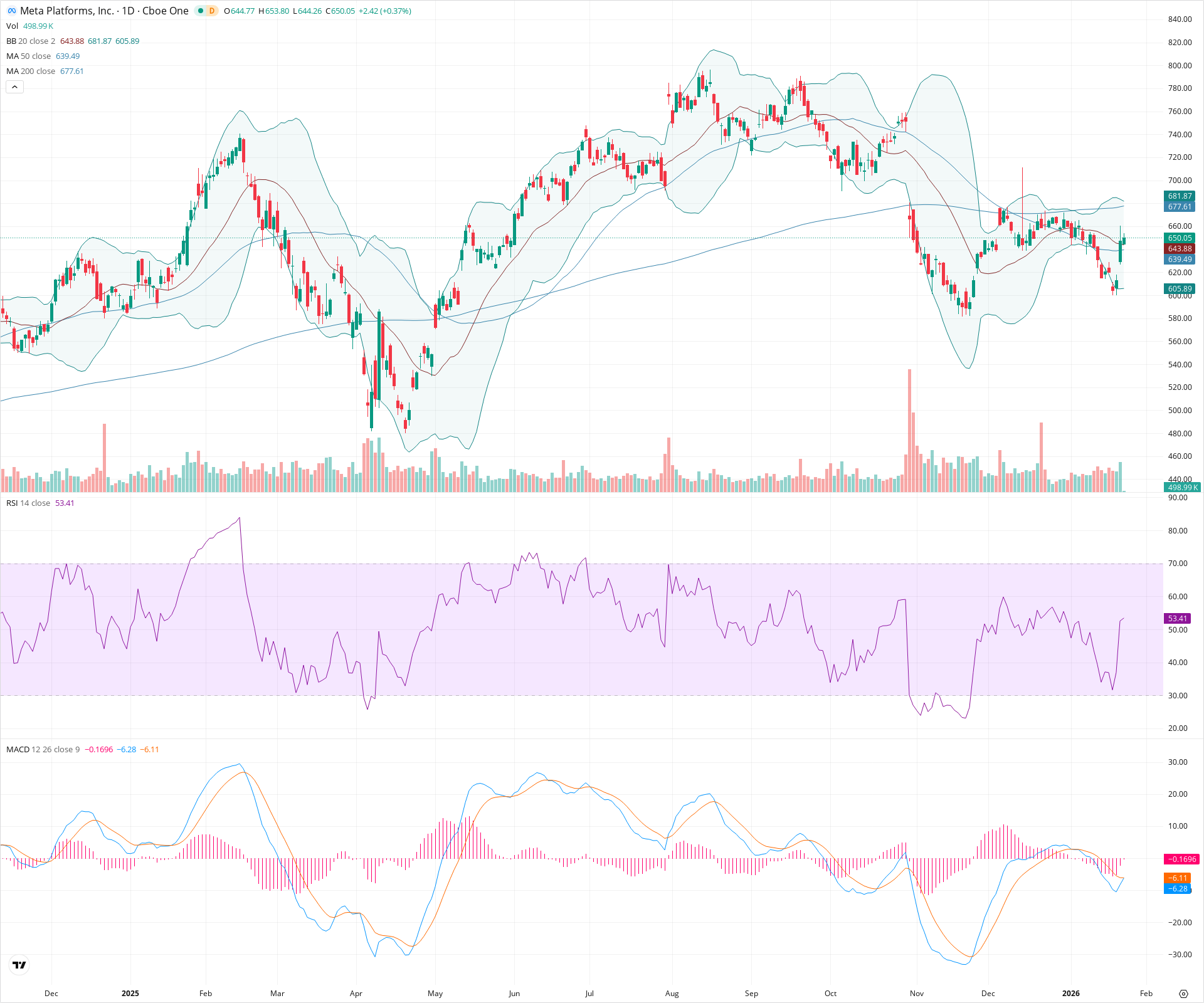

Meta is currently in a recovery phase, trading above its short-term moving averages (20 and 50-day), which are providing dynamic support around the 640 level. The formation of higher lows since November is a positive technical development, though the RSI remains neutral-bullish without extreme momentum. The primary challenge for the bulls lies at the 200-day SMA near 678; a breakout above this level is required to confirm a resumption of the long-term uptrend.

Included In Lists

Related Tickers of Interest

META Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is trading above both the 20-day and 50-day SMAs, with the 20-day recently crossing above the 50-day. RSI is above 50, indicating positive momentum, and recent price action shows higher lows.

Long-term Sentiment (weeks to months): Neutral

The stock remains below the key 200-day SMA (677.61), which acts as long-term dynamic resistance. While recovering, the long-term trend is not yet fully bullish until this level is reclaimed.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:05:33.875Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $641.69 | $639.49 - $643.88 | Strong | Confluence zone of the 20-day and 50-day Simple Moving Averages. |

| $610.00 | $605.00 - $615.00 | Weak | Recent swing low area coinciding with the lower Bollinger Band. |

| $555.00 | $550.00 - $560.00 | Strong | Significant swing low and structural support established in November. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $662.50 | $660.00 - $665.00 | Weak | Recent local highs and short-term consolidation ceiling. |

| $678.81 | $677.61 - $680.00 | Strong | The 200-day SMA serves as the primary overhead resistance level. |

| $710.00 | $700.00 - $720.00 | Strong | Previous major consolidation zone and breakdown level. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Higher Lows | Bullish | $677.61 | Since the major low in November, the price has formed a sequence of higher lows, suggesting a stabilizing trend and building buy-side pressure. |

| Weak | Short-Term MA Crossover | Bullish | N/A | The 20-day SMA has crossed slightly above the 50-day SMA, a technical signal often associated with short-term trend reversal to the upside. |

Frequently Asked Questions about META

What is the current sentiment for META?

The short-term sentiment for META is currently Bullish because Price is trading above both the 20-day and 50-day SMAs, with the 20-day recently crossing above the 50-day. RSI is above 50, indicating positive momentum, and recent price action shows higher lows.. The long-term trend is classified as Neutral.

What are the key support levels for META?

StockDips.AI has identified key support levels for META at $641.69 and $610.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is META in a significant dip or a Value Dip right now?

META has a Value Score of 8/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.