MSFT Daily Technical Analysis

Microsoft Corporation

Develops software, cloud computing, and AI tools including Windows, Office, and Azure.

MSFT Technical Analysis Summary

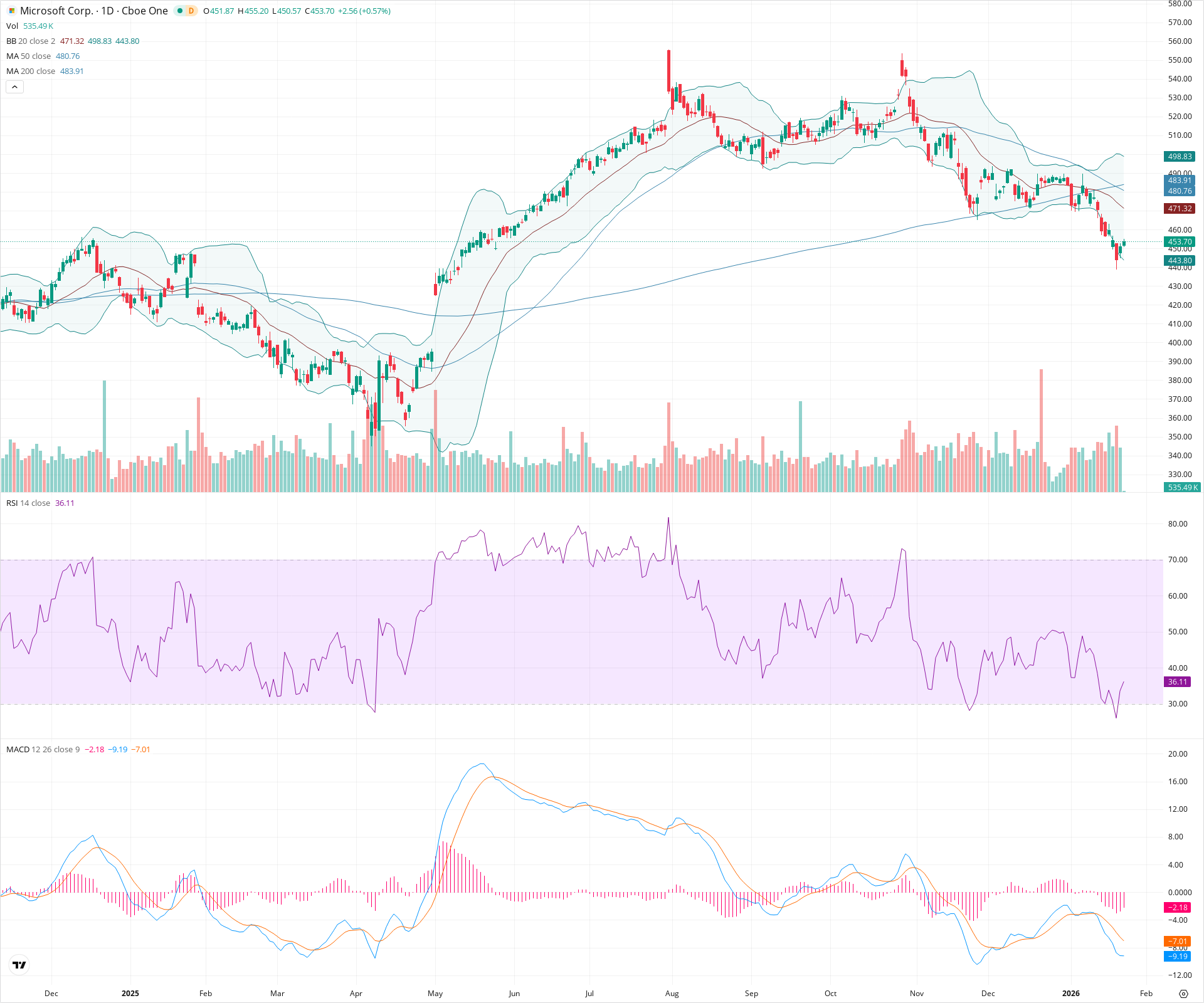

Microsoft is currently in a confirmed bearish trend on the daily timeframe, characterized by a recent Death Cross and price action sustained below all major moving averages. Momentum indicators like the MACD and RSI remain negative, though the RSI is approaching oversold levels which may allow for a minor relief bounce toward the 20-day SMA. The primary trend remains down unless price can reclaim the 480-484 resistance zone.

Included In Lists

Related Tickers of Interest

MSFT Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price is trading below the 20-day SMA and riding the lower Bollinger Band, with RSI (36.11) in bearish territory indicating weak momentum.

Long-term Sentiment (weeks to months): Bearish

A 'Death Cross' has occurred with the 50-day SMA crossing below the 200-day SMA, and price is consistently making lower highs and lower lows below these major averages.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:02:12.777Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $444.40 | $443.80 - $445.00 | Strong | Recent swing low and local bottom marked on the chart. |

| $392.50 | $385.00 - $400.00 | Strong | Major consolidation zone and swing lows visible from earlier in the chart period. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $473.16 | $471.32 - $475.00 | Weak | Coincides with the 20-day SMA and middle Bollinger Band. |

| $482.34 | $480.76 - $483.91 | Strong | Cluster of the 50-day and 200-day SMAs. |

| $501.50 | $498.00 - $505.00 | Strong | Previous swing high and psychological resistance level. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Death Cross | Bearish | N/A | The 50-day SMA (blue) has crossed below the 200-day SMA (red), signaling a long-term bearish trend shift. |

| Strong | Downtrend Structure | Bearish | $420.00 | Clear sequence of lower highs and lower lows since the peak above 550. |

Frequently Asked Questions about MSFT

What is the current sentiment for MSFT?

The short-term sentiment for MSFT is currently Bearish because Price is trading below the 20-day SMA and riding the lower Bollinger Band, with RSI (36.11) in bearish territory indicating weak momentum.. The long-term trend is classified as Bearish.

What are the key support levels for MSFT?

StockDips.AI has identified key support levels for MSFT at $444.40 and $392.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is MSFT in a significant dip or a Value Dip right now?

MSFT has a Value Score of 16/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.