GOOGL Daily Technical Analysis

Alphabet Inc

Parent of Google leading in search, advertising, YouTube, and cloud computing.

GOOGL Technical Analysis Summary

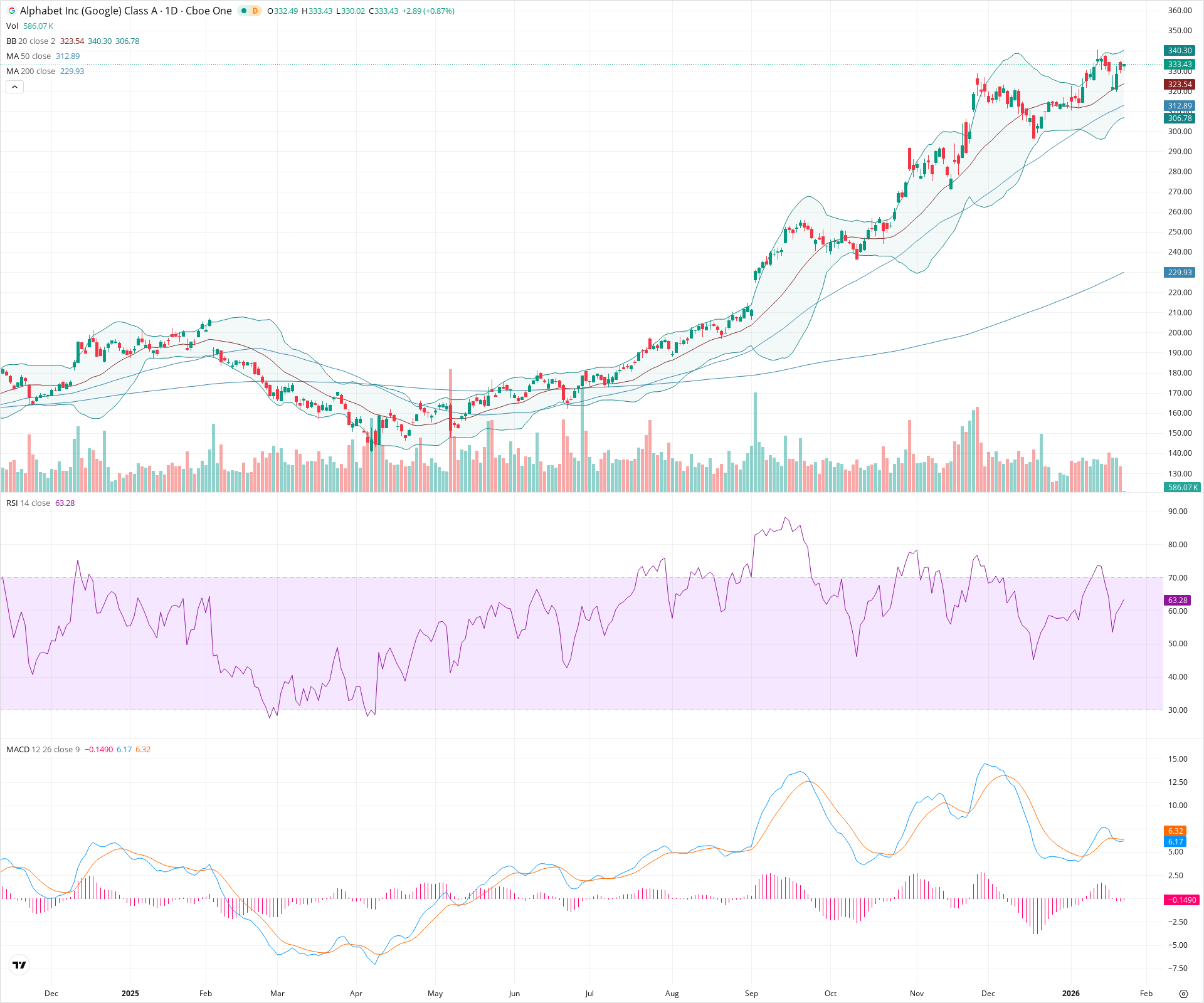

GOOGL remains in a strong technical uptrend, supported by rising moving averages and consistent price structure. The stock is currently rebounding off the 20-day SMA with healthy RSI levels, indicating potential for a retest of recent highs around 348. While the MACD has not yet crossed bullishly, the contracting histogram signals that the recent consolidation phase may be nearing its end.

Included In Lists

Related Tickers of Interest

GOOGL Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is trading above the 20-day SMA (323.54) and has recently bounced from this dynamic support. RSI (63.28) is rising and in bullish territory without being overbought. Although the MACD line is slightly below the signal line, the histogram is contracting, suggesting bearish momentum is fading.

Long-term Sentiment (weeks to months): Bullish

The stock is in a confirmed strong uptrend, trading well above the rising 50-day (312.89) and 200-day (229.93) SMAs. The chart structure consistently shows higher highs and higher lows.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:02:59.776Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $323.50 | $323.00 - $324.00 | Strong | Immediate dynamic support at the 20-day SMA (323.54). |

| $313.50 | $312.00 - $315.00 | Strong | Confluence of the 50-day SMA and recent swing lows. |

| $303.39 | $300.00 - $306.78 | Weak | Psychological support level and Lower Bollinger Band. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $344.15 | $340.30 - $348.00 | Strong | Upper Bollinger Band and the recent all-time high zone. |

| $357.50 | $355.00 - $360.00 | Weak | Projected extension resistance if recent highs are breached. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bullish Trend | Bullish | N/A | A sustained primary uptrend characterized by price action consistently respecting moving average supports. |

| Weak | Consolidation / Bull Flag | Bullish | $355.00 | Recent sideways-to-downward drift that has stabilized at the 20-day SMA, often preceding a continuation of the trend. |

Frequently Asked Questions about GOOGL

What is the current sentiment for GOOGL?

The short-term sentiment for GOOGL is currently Bullish because Price is trading above the 20-day SMA (323.54) and has recently bounced from this dynamic support. RSI (63.28) is rising and in bullish territory without being overbought. Although the MACD line is slightly below the signal line, the histogram is contracting, suggesting bearish momentum is fading.. The long-term trend is classified as Bullish.

What are the key support levels for GOOGL?

StockDips.AI has identified key support levels for GOOGL at $323.50 and $313.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is GOOGL in a significant dip or a Value Dip right now?

GOOGL has a Value Score of 77/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.