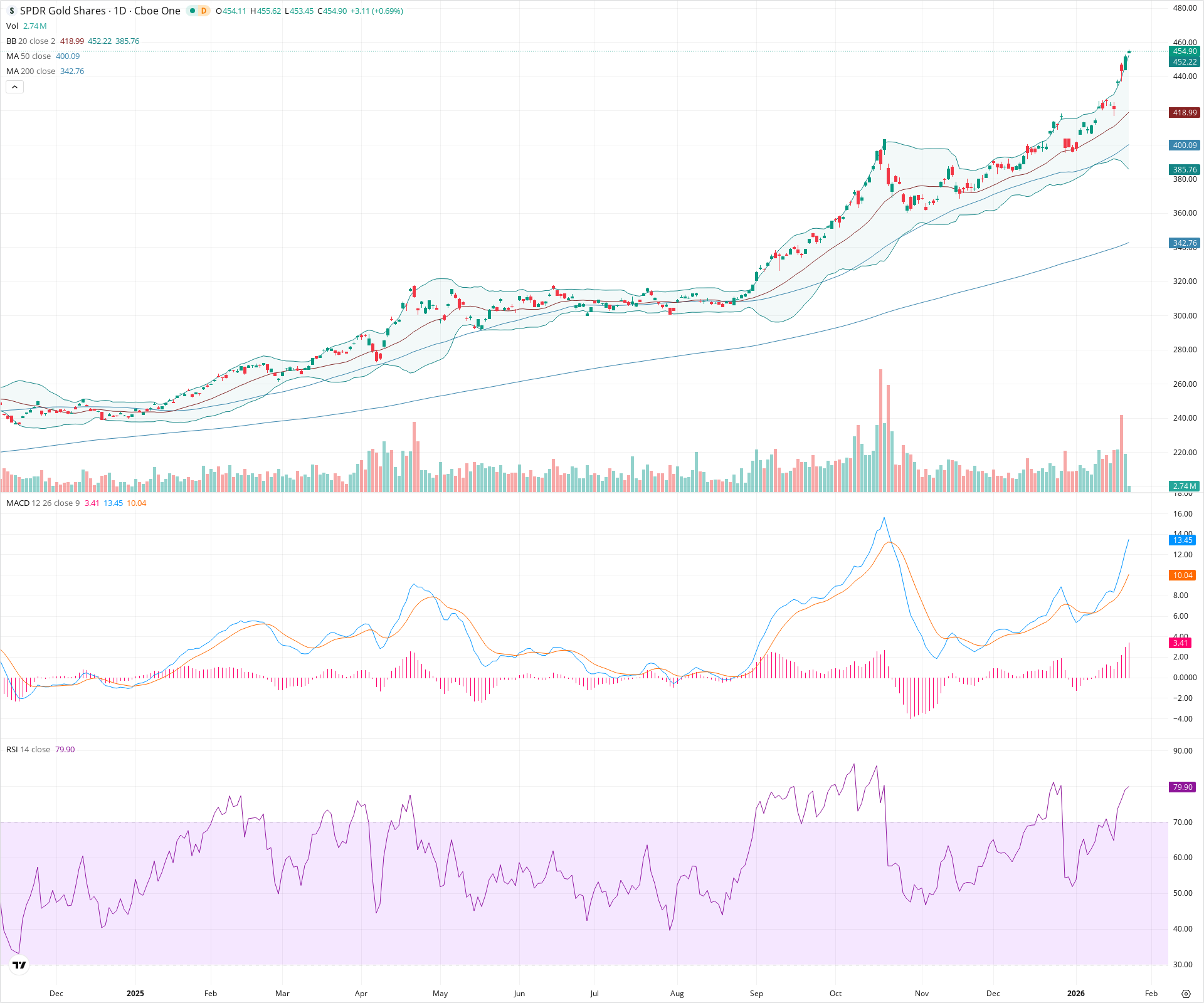

GLD Daily Technical Analysis

SPDR Gold Shares

Tracks the spot price of physical gold bullion held in secure vaults. Roughly ~1/10 oz of gold per share. Often used as a hedge against inflation, currency debasement, geopolitical risk, and financial market stress. Gold is considered a store of value and tends to perform well during risk-off environments.

GLD Technical Analysis Summary

GLD is exhibiting extreme strength, characterized by a parabolic move to new highs and strong momentum indicators, including a rising MACD and price adhering to the upper Bollinger Band. While the long-term trend is firmly bullish with perfect moving average alignment, the RSI near 80 suggests the asset is overextended in the short term and may be due for a consolidation or pullback. Investors should watch the 418-420 zone as critical support on any retracement.

Included In Lists

Related Tickers of Interest

GLD Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is making new highs and walking the upper Bollinger Band with expanding MACD momentum, though RSI at ~80 warns of overbought conditions.

Long-term Sentiment (weeks to months): Bullish

The stock is in a confirmed strong uptrend, trading significantly above the rising 20, 50, and 200-day moving averages.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:19:21.483Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $420.00 | $418.00 - $422.00 | Strong | Confluence of the 20-day SMA and a previous breakout resistance zone. |

| $400.00 | $398.00 - $402.00 | Strong | Location of the rising 50-day SMA and psychological round number support. |

| $382.50 | $380.00 - $385.00 | Weak | Previous consolidation lows and proximity to the lower Bollinger Band area from earlier swings. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $455.26 | $454.90 - $455.62 | Weak | Immediate resistance at the current daily high and closing price level. |

| $462.50 | $460.00 - $465.00 | Strong | Psychological resistance and potential extension target for the parabolic move. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Uptrend | Bullish | N/A | Price is accelerating upwards with a steepening slope, riding the upper Bollinger Band. |

| Strong | Bullish Breakout | Bullish | $460.00 | Recent decisive move above the 420 consolidation zone, confirmed by expanding volume and MACD. |

Frequently Asked Questions about GLD

What is the current sentiment for GLD?

The short-term sentiment for GLD is currently Bullish because Price is making new highs and walking the upper Bollinger Band with expanding MACD momentum, though RSI at ~80 warns of overbought conditions.. The long-term trend is classified as Bullish.

What are the key support levels for GLD?

StockDips.AI has identified key support levels for GLD at $420.00 and $400.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is GLD in a significant dip or a Value Dip right now?

GLD has a Value Score of -9/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.