GLD Weekly Technical Analysis

SPDR Gold Shares

Tracks the spot price of physical gold bullion held in secure vaults. Roughly ~1/10 oz of gold per share. Often used as a hedge against inflation, currency debasement, geopolitical risk, and financial market stress. Gold is considered a store of value and tends to perform well during risk-off environments.

GLD Technical Analysis Summary

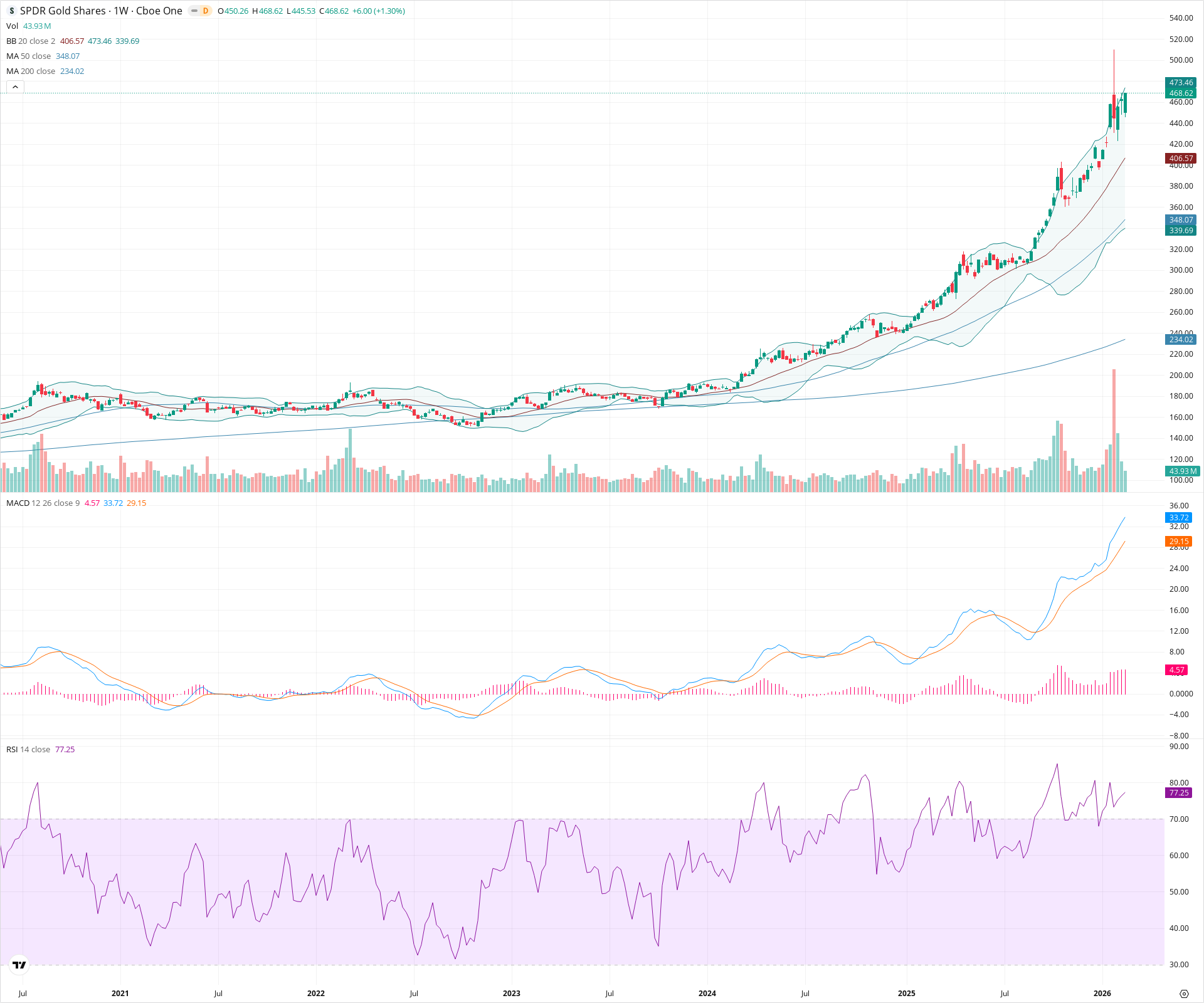

The weekly chart displays an exceptionally strong and accelerating long-term uptrend, characterized by a breakout from a massive multi-year base. Moving averages are in perfect bullish alignment and sharply rising, while MACD confirms robust underlying momentum. Although the RSI is highly overbought at 77.25—suggesting the potential for a near-term pause or volatile pullback—the overarching structural picture remains overwhelmingly positive for long-term investors.

Included In Lists

Related Tickers of Interest

GLD Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is in a steep ascent, making aggressive higher highs and higher lows while riding the upper Bollinger Band. MACD histogram is positive and expanding, confirming strong short-term momentum.

Long-term Sentiment (weeks to months): Bullish

The chart shows a textbook long-term uptrend with price firmly above all key moving averages (20, 50, and 200-week SMAs), which are sequentially stacked and sloping upward after a massive multi-year base breakout.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:02:34.381Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $410.00 | $400.00 - $420.00 | Strong | Recent consolidation shelf prior to the latest vertical leg up, converging with the rising 20-week SMA. |

| $335.00 | $320.00 - $350.00 | Strong | Major structural swing low and significant consolidation area, currently aligning with the rising 50-week SMA. |

| $240.00 | $230.00 - $250.00 | Strong | Long-term base area and trend origin, aligning with the 200-week SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $475.00 | $470.00 - $480.00 | Weak | Immediate resistance near current all-time highs and the weekly upper Bollinger Band (473.46). |

| $500.00 | $495.00 - $505.00 | Strong | Major psychological resistance zone at the 500 round number in price discovery territory. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Uptrend | Bullish | N/A | The price action since early 2024 has accelerated into a very steep, nearly vertical channel, indicating extreme buying pressure and momentum. |

| Strong | Multi-Year Base Breakout | Bullish | N/A | The current accelerating trend is the result of a massive breakout from a multi-year consolidation phase, which provides a profound long-term foundation. |

Frequently Asked Questions about GLD

What is the current sentiment for GLD?

The short-term sentiment for GLD is currently Bullish because Price is in a steep ascent, making aggressive higher highs and higher lows while riding the upper Bollinger Band. MACD histogram is positive and expanding, confirming strong short-term momentum.. The long-term trend is classified as Bullish.

What are the key support levels for GLD?

StockDips.AI has identified key support levels for GLD at $410.00 and $335.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is GLD in a significant dip or a Value Dip right now?

GLD has a Value Score of 75/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.