GOOGL Weekly Technical Analysis

Alphabet Inc

Parent of Google leading in search, advertising, YouTube, and cloud computing.

GOOGL Technical Analysis Summary

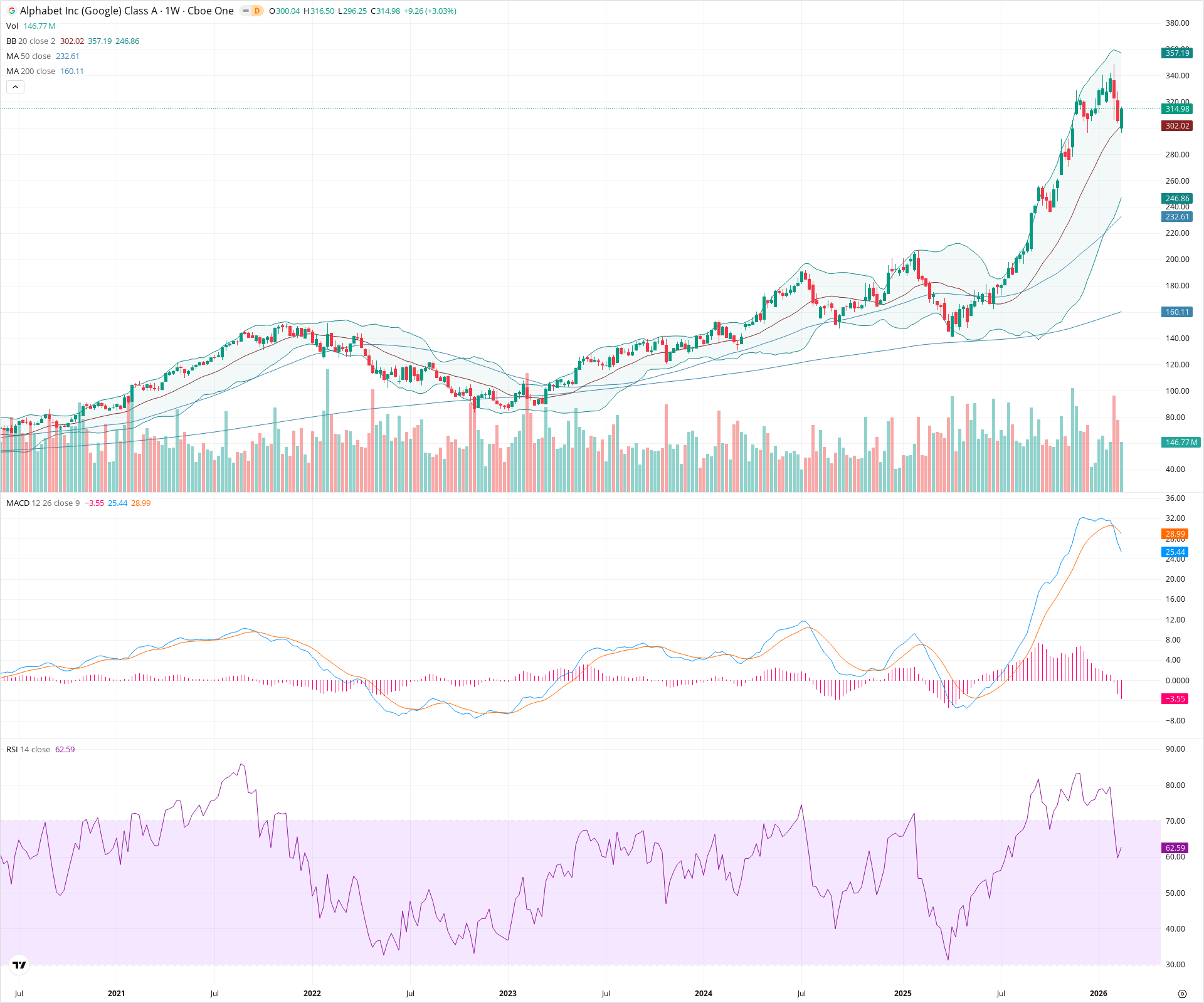

GOOGL remains in a powerful, secular long-term uptrend on the weekly chart following a massive multi-year base breakout. While the price is currently digesting a recent parabolic advance with a sharp pullback from its highs, the structural damage is minimal, and price remains comfortably above key rising moving averages (20-week and 50-week SMAs). Long-term investors should view pullbacks toward structural support zones as potential buying opportunities within the context of an enduring primary bull market.

Included In Lists

Related Tickers of Interest

GOOGL Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is making a series of higher highs and higher lows above the rising 20-week and 50-week moving averages, despite a recent pullback. RSI remains firmly in the bullish zone above 50, and MACD continues to reflect strong upward momentum, with the signal line well above the zero line.

Long-term Sentiment (weeks to months): Bullish

The long-term trend is clearly up, characterized by a massive multi-year advance following a significant base breakout. The 50-week SMA is well above the 200-week SMA, and both are trending upward, confirming the enduring primary bull market.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:32:57.725Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $245.00 | $240.00 - $250.00 | Strong | Major prior resistance zone turned support, coinciding closely with the rising 50-week SMA. |

| $185.00 | $180.00 - $190.00 | Strong | Significant multi-year breakout level and major structural support zone. |

| $145.00 | $140.00 - $150.00 | Weak | Previous structural swing high area that served as interim support during a major corrective phase. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $355.00 | $350.00 - $360.00 | Strong | Recent all-time high area where price was rejected, establishing the current major resistance. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Advance / Exhaustion Pullback | Neutral | N/A | Price recently experienced a near-vertical advance, distancing itself significantly from major moving averages, followed by a sharp pullback from the peak, suggesting near-term exhaustion but within an ongoing strong uptrend. |

| Strong | Multi-Year Cup and Handle Breakout | Bullish | N/A | The chart shows a massive multi-year consolidation base resembling a massive cup and handle that broke out powerfully around the 150-160 level, leading to the current sustained secular advance. |

Frequently Asked Questions about GOOGL

What is the current sentiment for GOOGL?

The short-term sentiment for GOOGL is currently Bullish because Price is making a series of higher highs and higher lows above the rising 20-week and 50-week moving averages, despite a recent pullback. RSI remains firmly in the bullish zone above 50, and MACD continues to reflect strong upward momentum, with the signal line well above the zero line.. The long-term trend is classified as Bullish.

What are the key support levels for GOOGL?

StockDips.AI has identified key support levels for GOOGL at $245.00 and $185.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is GOOGL in a significant dip or a Value Dip right now?

GOOGL has a Value Score of 32/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.