NBIS Daily Technical Analysis

Nebius Group

technology company specializing in infrastructure for the artificial intelligence (AI) industry

NBIS Technical Analysis Summary

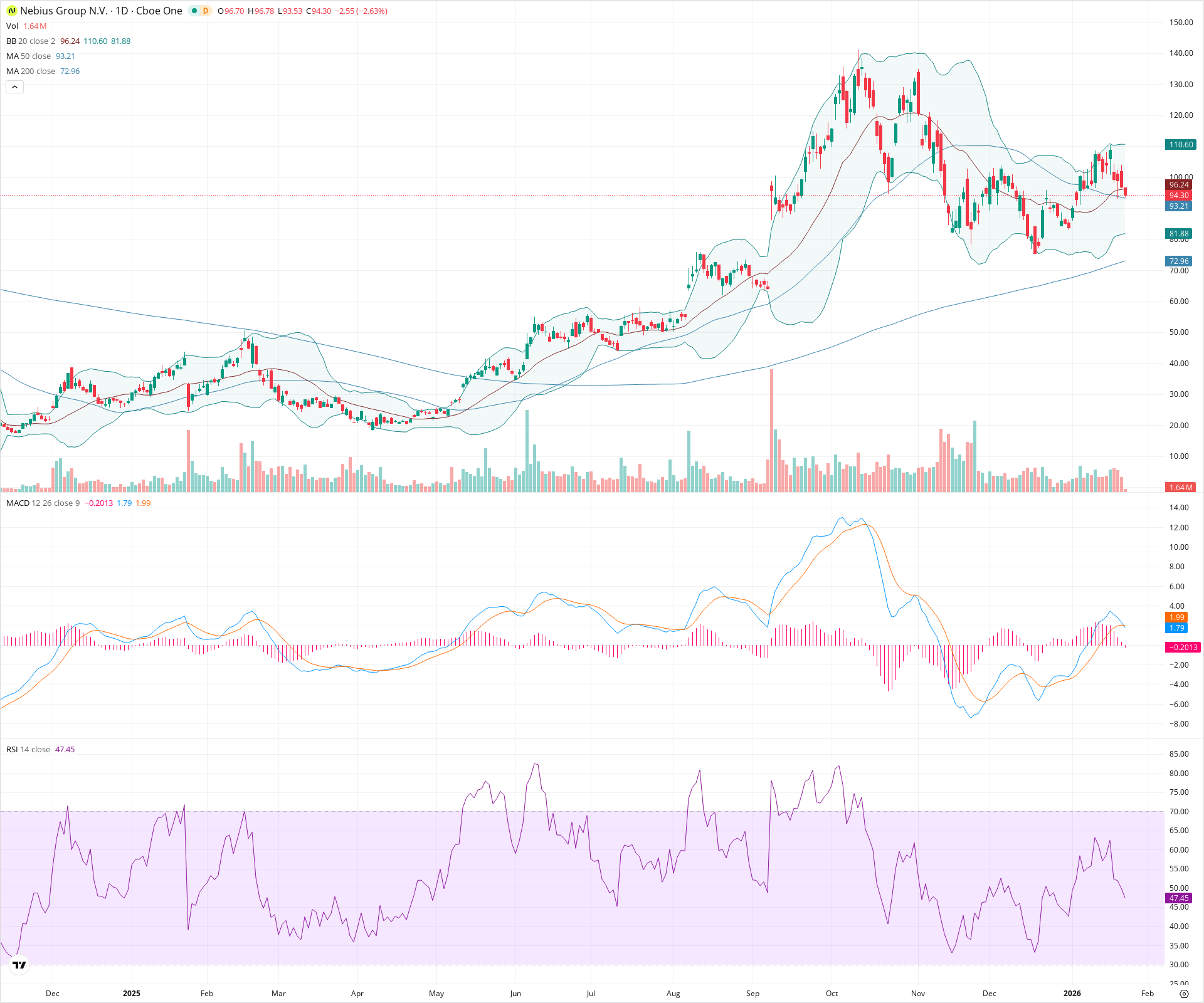

NBIS is currently in a corrective phase within a larger uptrend, trading between the 20-day and 50-day moving averages. While the long-term structure remains bullish above the rising 200-day SMA, short-term signals are cautious due to a bearish MACD crossover and the formation of a lower high around 110. A breakdown below the 50-day SMA (93.21) could see price test the stronger support near 80, whereas a reclaim of the 20-day SMA is needed to neutralize the immediate bearish bias.

Included In Lists

Related Tickers of Interest

NBIS Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price has fallen below the 20-day SMA and is currently testing the 50-day SMA. Momentum is negative with a bearish MACD crossover (MACD line below Signal line) and the RSI declining below 50.

Long-term Sentiment (weeks to months): Bullish

The long-term trend remains upward as price sits significantly above the rising 200-day SMA. The 50-day SMA is also still sloping positively, indicating the primary trend has not yet reversed.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:14:12.977Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $93.10 | $93.00 - $93.21 | Weak | Immediate support at the 50-day Simple Moving Average, which is currently being tested. |

| $81.00 | $80.00 - $82.00 | Strong | Recent significant swing low zone and alignment with the lower Bollinger Band. |

| $71.50 | $70.00 - $73.00 | Strong | Major structural support zone coincident with the rising 200-day SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $96.25 | $96.00 - $96.50 | Weak | The 20-day SMA and Bollinger Band basis line acting as immediate overhead resistance. |

| $111.00 | $110.00 - $112.00 | Strong | Recent swing high representing a lower high relative to the all-time peak. |

| $140.00 | $138.00 - $142.00 | Strong | All-time high resistance area established in October. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Weak | Potential Head and Shoulders | Bearish | N/A | A complex top formation resembling a Head and Shoulders pattern is visible (Left Shoulder ~110, Head ~140, Right Shoulder ~110), suggesting a potential medium-term reversal if the neckline breaks. |

| Strong | Lower High | Bearish | N/A | The most recent rally failed to reach the previous highs, peaking around 110 versus 140, indicating a loss of bullish momentum. |

Frequently Asked Questions about NBIS

What is the current sentiment for NBIS?

The short-term sentiment for NBIS is currently Bearish because Price has fallen below the 20-day SMA and is currently testing the 50-day SMA. Momentum is negative with a bearish MACD crossover (MACD line below Signal line) and the RSI declining below 50.. The long-term trend is classified as Bullish.

What are the key support levels for NBIS?

StockDips.AI has identified key support levels for NBIS at $93.10 and $81.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is NBIS in a significant dip or a Value Dip right now?

NBIS has a Value Score of -60/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.