SNDK Daily Technical Analysis

SanDisk Corp

Designs and manufactures flash memory products and solutions, including solid-state drives (SSDs), memory cards, and USB flash drives. The company develops products for a wide range of applications, from consumer electronics to high-growth data centers and AI computing.

SNDK Technical Analysis Summary

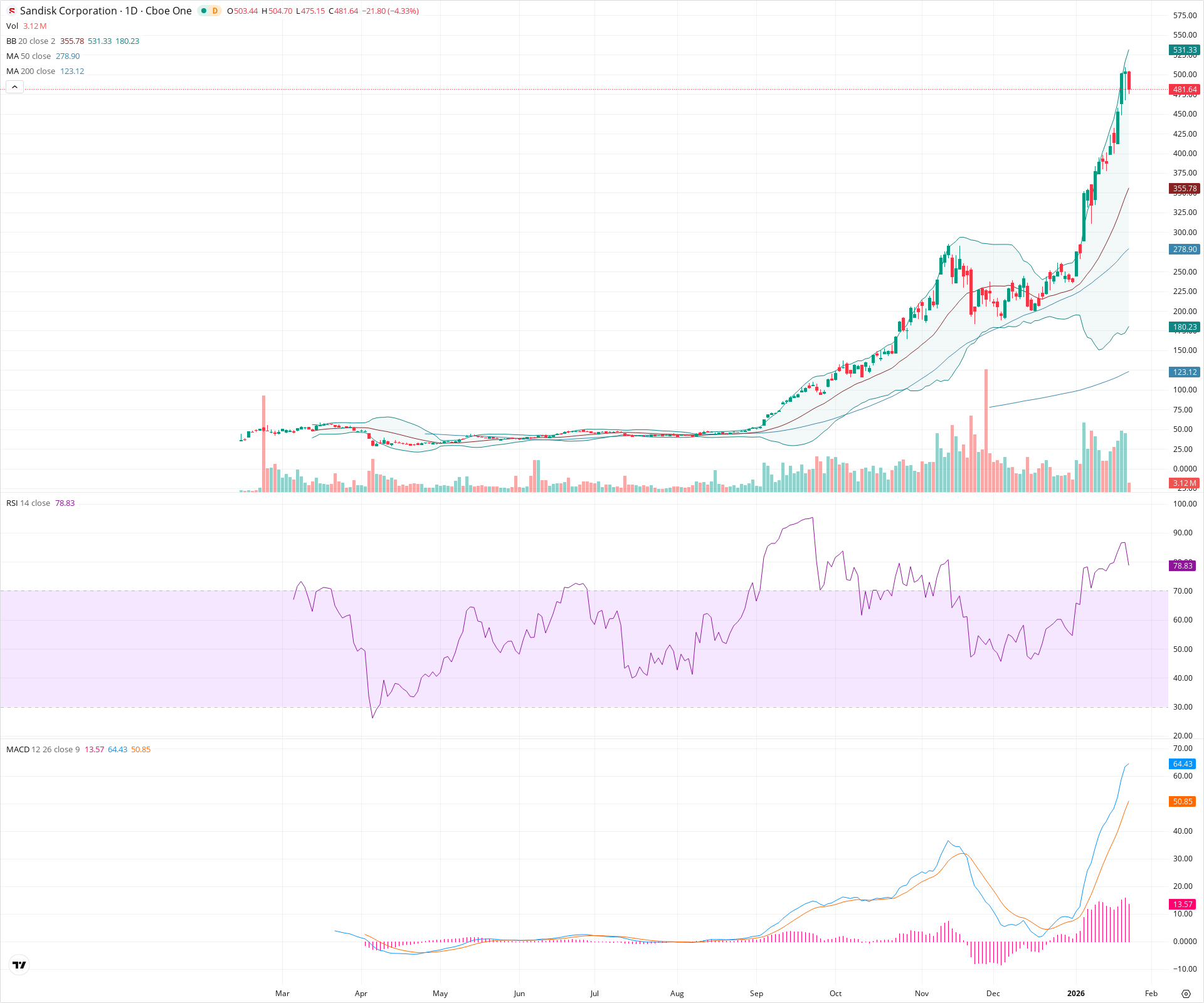

SNDK is in a powerful parabolic uptrend, trading well above its upper Bollinger Band and long-term moving averages. However, the current session shows a significant 4.33% pullback with high volume, coinciding with an extremely overbought RSI of nearly 79. This suggests the stock is entering a phase of mean reversion or consolidation after an extended run. While the long-term bullish structure is intact, short-term caution is warranted as the price attempts to stabilize from vertical appreciation.

Included In Lists

Related Tickers of Interest

SNDK Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

While the primary trend is parabolic, the stock is currently experiencing a sharp -4.33% pullback from extreme overbought levels (RSI > 78), suggesting potential volatility and profit-taking in the immediate term.

Long-term Sentiment (weeks to months): Bullish

The price is in a strong uptrend, trading significantly above the rising 50-day and 200-day moving averages, with the 200-day SMA clearly trending upward.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:10:58.586Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $355.00 | $350.00 - $360.00 | Strong | Confluence of the 20-day SMA (mid-Bollinger Band) and a prior consolidation zone. |

| $280.00 | $275.00 - $285.00 | Strong | Location of the 50-day SMA and a major breakout shelf. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $504.50 | $504.00 - $505.00 | Weak | Intraday high of the current session. |

| $538.00 | $531.00 - $545.00 | Strong | Recent all-time high zone and area around the upper Bollinger Band. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Advance | Bullish | N/A | Price has moved vertically in a short period, detaching significantly from moving averages. |

| Weak | Bearish Reversal Candle | Bearish | $355.78 | A large red candle following a strong uptrend, indicating immediate selling pressure and potential local top. |

Frequently Asked Questions about SNDK

What is the current sentiment for SNDK?

The short-term sentiment for SNDK is currently Neutral because While the primary trend is parabolic, the stock is currently experiencing a sharp -4.33% pullback from extreme overbought levels (RSI > 78), suggesting potential volatility and profit-taking in the immediate term.. The long-term trend is classified as Bullish.

What are the key support levels for SNDK?

StockDips.AI has identified key support levels for SNDK at $355.00 and $280.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is SNDK in a significant dip or a Value Dip right now?

SNDK has a Value Score of 2/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.