NVDA Weekly Technical Analysis

NVIDIA Corporation

Designs GPUs and AI chips for gaming, data centers, and artificial intelligence systems.

NVDA Technical Analysis Summary

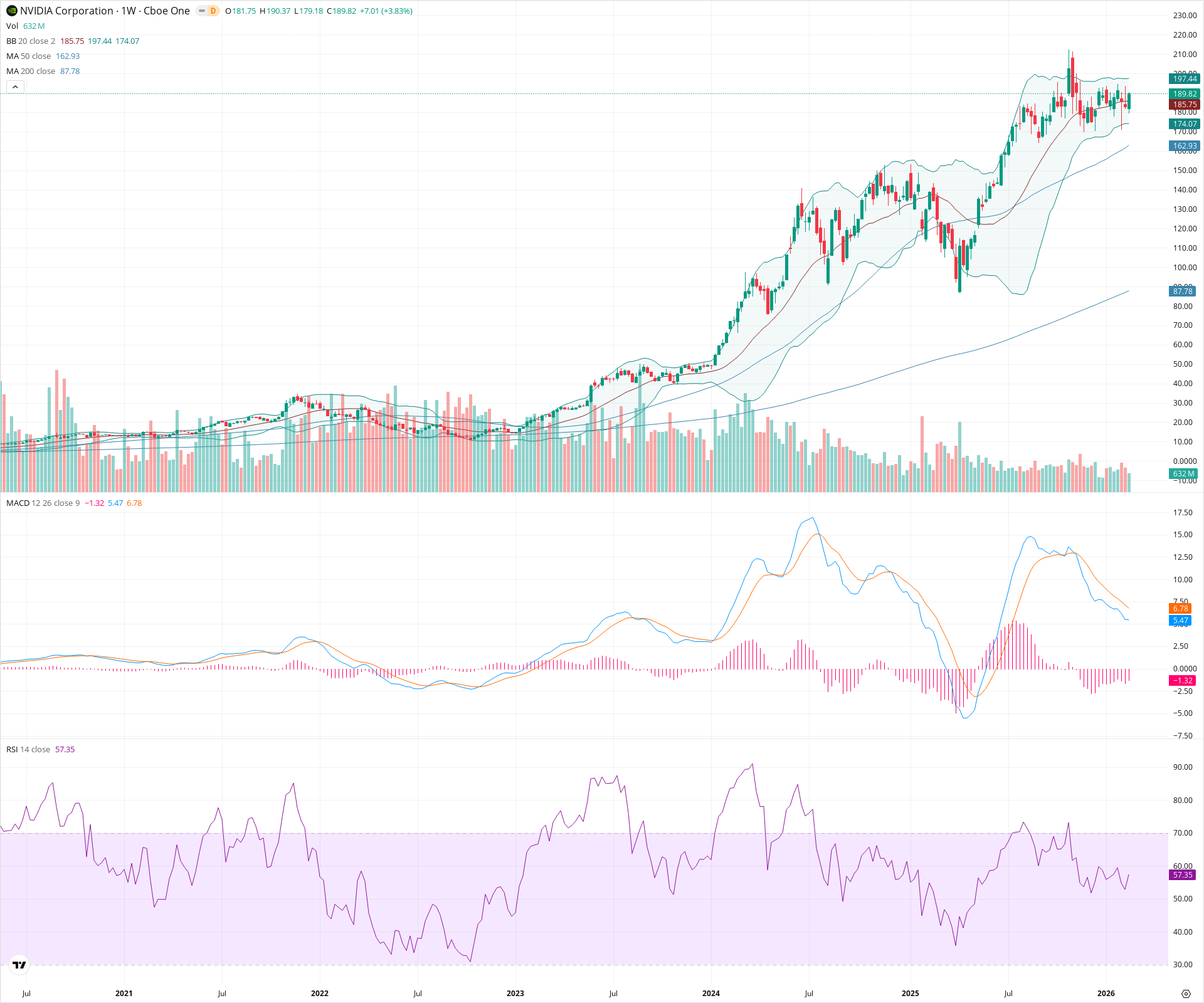

NVIDIA (NVDA) remains in a powerful long-term uptrend, clearly defined by price action holding well above upward-sloping key moving averages. The recent pullback appears to be a normal consolidation that successfully relieved overbought conditions on the RSI. With downward momentum on the MACD histogram receding and price turning higher, the technical structure favors continued upside and a likely re-test of structural highs.

Included In Lists

Related Tickers of Interest

NVDA Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is bouncing from a recent multi-week pullback, reclaiming position near the 20-week SMA. The RSI has cooled off and is curling upwards, while the MACD histogram shows waning negative momentum.

Long-term Sentiment (weeks to months): Bullish

The stock is in a dominant secular uptrend, trading well above strongly rising 50-week and 200-week SMAs. The MACD lines remain deep in positive territory.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:33:18.433Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $170.00 | $165.00 - $175.00 | Strong | Recent swing low consolidation zone and confluence with the rising 50-week SMA. |

| $135.00 | $130.00 - $140.00 | Strong | Prior major breakout and consolidation level establishing a strong structural base. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $200.00 | $195.00 - $205.00 | Strong | All-time high peak area and major psychological resistance zone. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bullish Consolidation | Bullish | $205.00 | After a steep, prolonged run, price has experienced a constructive multi-week pullback, finding support and forming a higher base. This suggests a healthy pause to digest gains before potential trend continuation. |

Frequently Asked Questions about NVDA

What is the current sentiment for NVDA?

The short-term sentiment for NVDA is currently Bullish because Price is bouncing from a recent multi-week pullback, reclaiming position near the 20-week SMA. The RSI has cooled off and is curling upwards, while the MACD histogram shows waning negative momentum.. The long-term trend is classified as Bullish.

What are the key support levels for NVDA?

StockDips.AI has identified key support levels for NVDA at $170.00 and $135.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is NVDA in a significant dip or a Value Dip right now?

NVDA has a Value Score of 66/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.