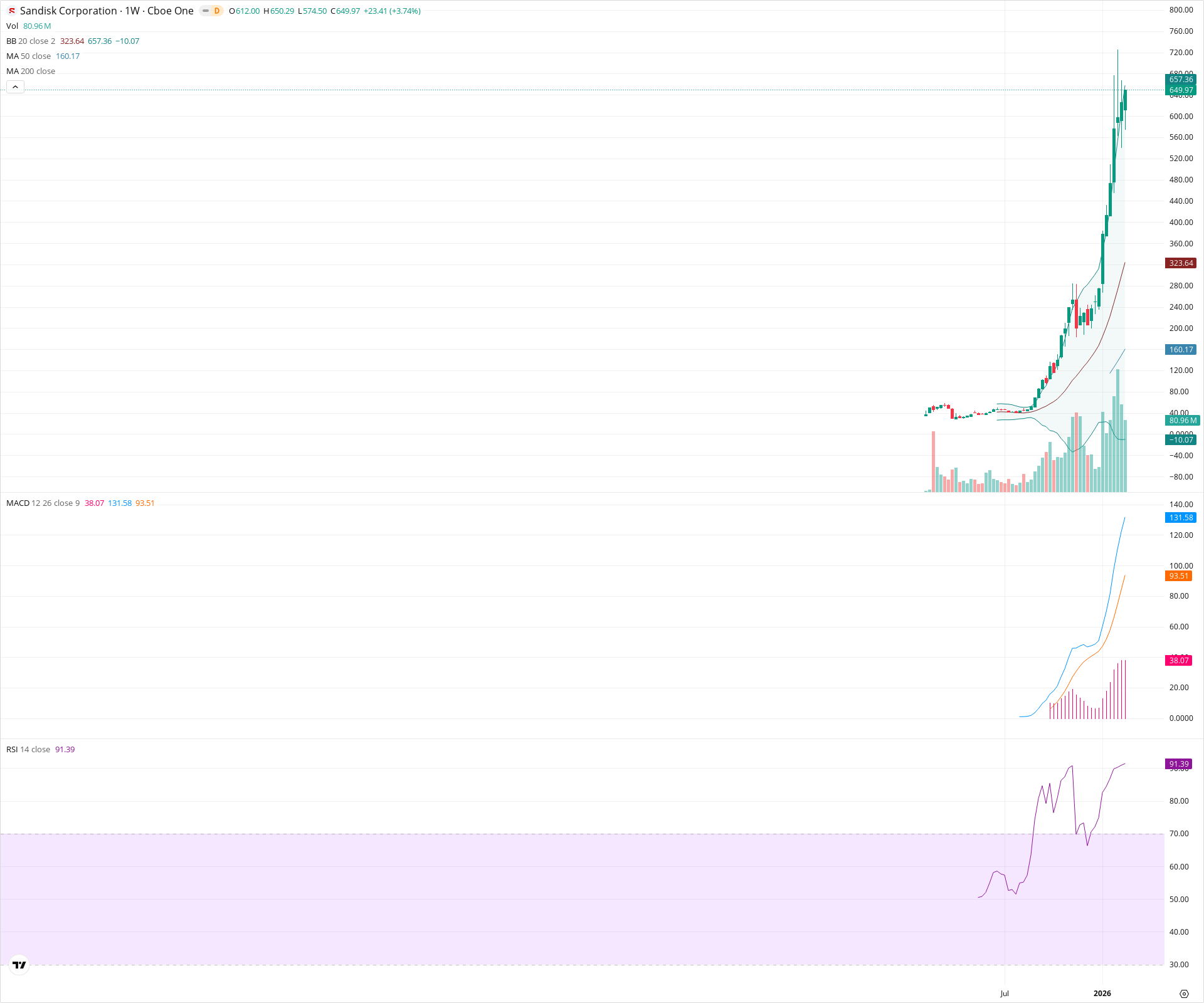

SNDK Weekly Technical Analysis

SanDisk Corp

Designs and manufactures flash memory products and solutions, including solid-state drives (SSDs), memory cards, and USB flash drives. The company develops products for a wide range of applications, from consumer electronics to high-growth data centers and AI computing.

SNDK Technical Analysis Summary

SNDK is in a massive, parabolic multi-year uptrend on the weekly chart, currently trading at all-time highs. Both short-term and long-term momentum indicators (MACD, RSI) confirm extreme bullishness, though the RSI is deeply overbought. While the primary trend is undeniably strong, investors should be cautious of the steepness of the advance, which often precedes volatile corrections back toward rising moving averages like the 20-week or 50-week SMAs.

Included In Lists

Related Tickers of Interest

SNDK Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is making strong new highs well above rising moving averages, supported by strong momentum shown in MACD and RSI.

Long-term Sentiment (weeks to months): Bullish

The chart exhibits a powerful parabolic uptrend with all major moving averages trailing upwards and strong long-term momentum indicators.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:36:04.532Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $500.00 | $480.00 - $520.00 | Weak | Initial support near the 20-week SMA (cyan line) and recent consolidation area before the latest explosive move up. |

| $340.00 | $320.00 - $360.00 | Strong | Major prior resistance zone turned support, coinciding closely with the 50-week SMA (red line) region. |

| $220.00 | $200.00 - $240.00 | Strong | Historical base breakout level, reinforced by the 200-week SMA (blue line) acting as a very long-term floor. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $740.00 | $720.00 - $760.00 | Weak | Potential psychological resistance or next immediate target area above current all-time highs as the chart continues into price discovery. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Parabolic Advance | Bullish | N/A | The price has entered a steep, near-vertical ascent over the past several months, indicating extreme bullish momentum but also heightened risk of a sharp mean-reversion pullback. |

Frequently Asked Questions about SNDK

What is the current sentiment for SNDK?

The short-term sentiment for SNDK is currently Bullish because Price is making strong new highs well above rising moving averages, supported by strong momentum shown in MACD and RSI.. The long-term trend is classified as Bullish.

What are the key support levels for SNDK?

StockDips.AI has identified key support levels for SNDK at $500.00 and $340.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is SNDK in a significant dip or a Value Dip right now?

SNDK has a Value Score of 50/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.