CORZ Weekly Technical Analysis

Core Scientific Inc

Major U.S. Bitcoin miner providing hosting and self-mining services.

CORZ Technical Analysis Summary

CORZ exhibits a highly bullish long-term chart, characterized by a massive recovery and sustained uptrend supported by a rising 50-week SMA. Currently, the stock is experiencing a healthy, medium-term consolidation phase to digest extreme gains. While short-term momentum indicators like MACD reflect this cooling period, the primary trend remains decisively upward as long as crucial support in the $14 zone holds.

Included In Lists

Related Tickers of Interest

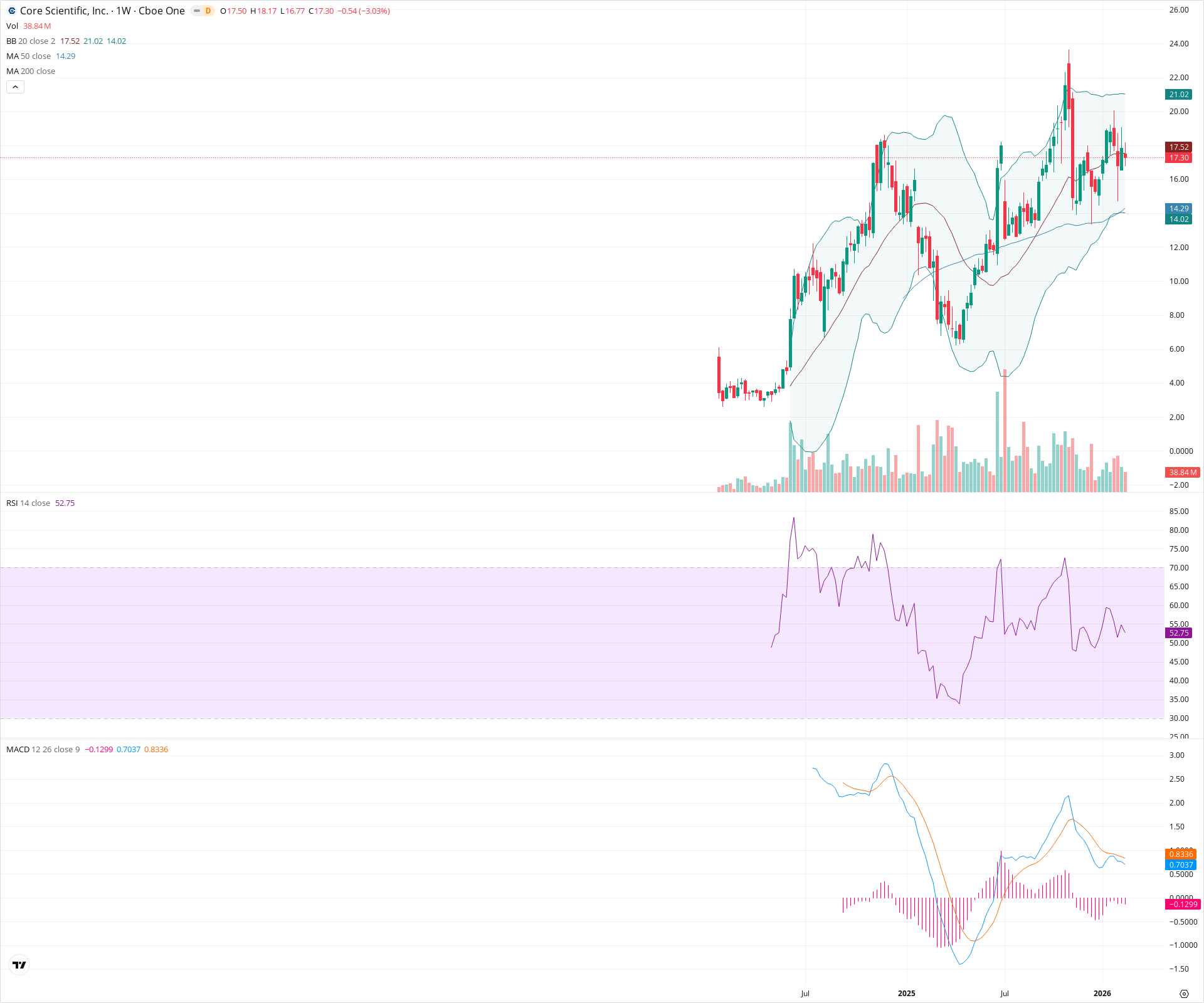

CORZ Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is in a corrective phase following a strong rally, currently consolidating just below the 20-week SMA. The MACD has posted a bearish crossover with expanding negative histogram, indicating short-term momentum has cooled, but RSI remains above 50.

Long-term Sentiment (weeks to months): Bullish

The macro structure shows a massive, sustained uptrend originating from deep lows. The price remains significantly above a steeply rising 50-week SMA, and prior structural resistance has been cleanly overcome.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:38:05.837Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $14.25 | $13.50 - $15.00 | Strong | Major confluence zone consisting of recent swing lows and the rapidly rising 50-week SMA. |

| $7.00 | $6.00 - $8.00 | Strong | Major multi-month structural trough and base before the primary leg up. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $18.75 | $18.00 - $19.50 | Weak | Immediate overhead resistance zone defined by recent consolidation highs and the 20-week SMA. |

| $23.25 | $22.00 - $24.50 | Strong | The area of recent structural peak highs, marked by significant wicks indicating supply. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | High-Tight Flag / Wide Consolidation | Bullish | N/A | Following a very steep, multi-month parabolic run, the price is establishing a wide consolidation range. Given the preceding trend, this acts as an extended resting phase. |

Frequently Asked Questions about CORZ

What is the current sentiment for CORZ?

The short-term sentiment for CORZ is currently Neutral because Price is in a corrective phase following a strong rally, currently consolidating just below the 20-week SMA. The MACD has posted a bearish crossover with expanding negative histogram, indicating short-term momentum has cooled, but RSI remains above 50.. The long-term trend is classified as Bullish.

What are the key support levels for CORZ?

StockDips.AI has identified key support levels for CORZ at $14.25 and $7.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is CORZ in a significant dip or a Value Dip right now?

CORZ has a Value Score of 67/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.