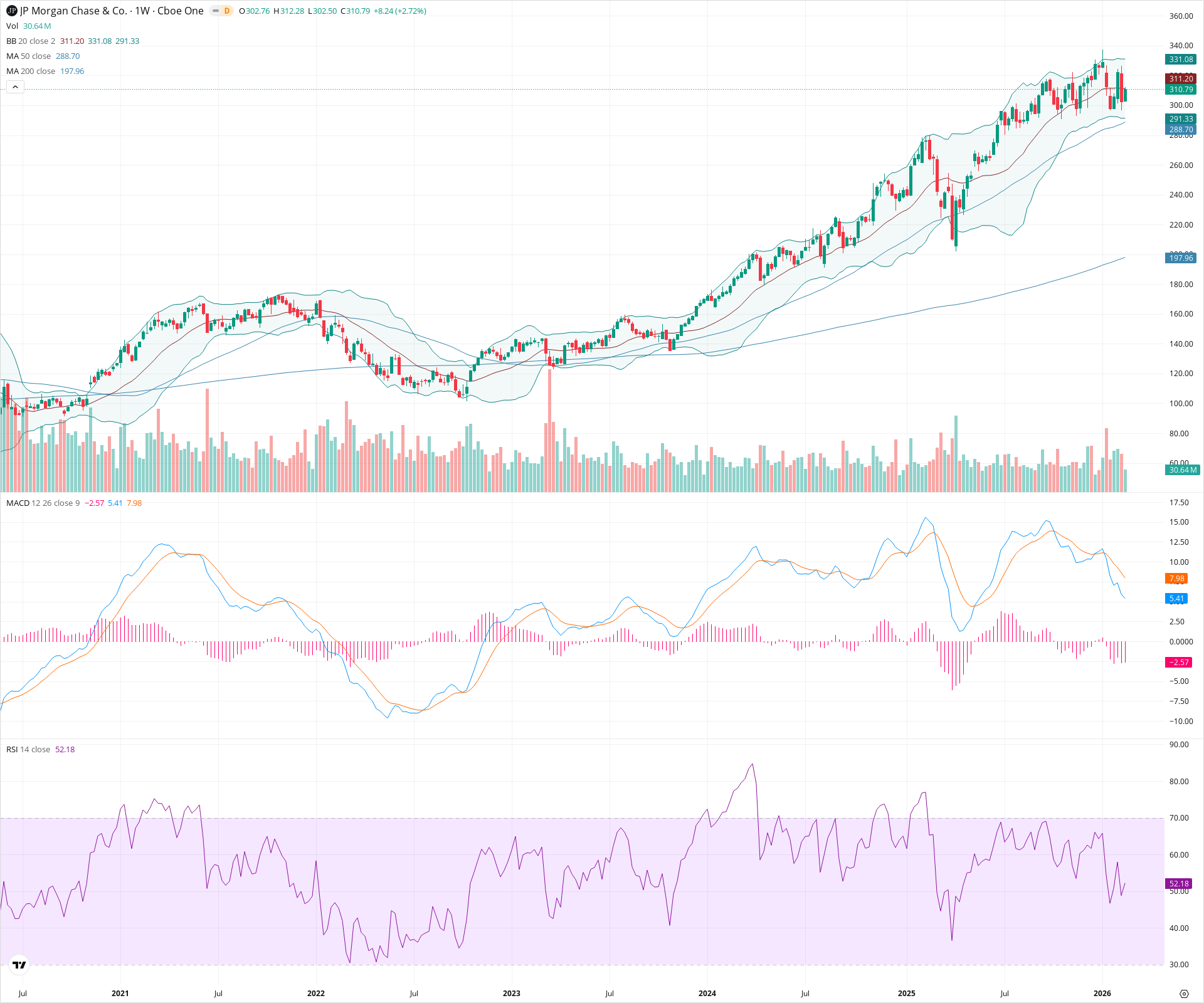

JPM Weekly Technical Analysis

JPMorgan Chase & Co.

Largest U.S. bank providing consumer, corporate, and investment banking services.

JPM Technical Analysis Summary

JPM is in a confirmed and robust long-term uptrend, trading well above its major moving averages. However, bearish momentum divergences on the RSI and MACD have played out, leading to a healthy intermediate pullback. The stock is currently testing initial support near its 20-week SMA, with stronger structural support awaiting near the 285-290 zone if weakness persists.

Included In Lists

Related Tickers of Interest

JPM Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price is pulling back from recent highs with consecutive strong red candles. The MACD has crossed below its signal line with an expanding negative histogram, and the RSI is declining towards the 50 level, indicating downward short-term momentum.

Long-term Sentiment (weeks to months): Bullish

The broader structure remains a sequence of higher highs and higher lows. The price is trading well above the sharply rising 50-week and 200-week SMAs, confirming a strong long-term structural uptrend.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:33:44.726Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $308.25 | $305.00 - $311.50 | Weak | Current test zone aligning with the 20-week SMA (middle Bollinger Band). |

| $288.50 | $285.00 - $292.00 | Strong | Confluence of the rising 50-week SMA, lower Bollinger Band, and a prior multi-week consolidation base. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $344.00 | $340.00 - $348.00 | Strong | Recent swing high and all-time high zone where the price faced strong rejection. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bearish Divergence | Bearish | N/A | Price formed a recent higher high, but both the RSI and MACD formed lower highs, indicating waning upward momentum before the current pullback. |

| Strong | Long-Term Uptrend Channel | Bullish | N/A | A steady multi-year progression of higher highs and higher lows defined by price respect for the 50-week SMA during major pullbacks. |

Frequently Asked Questions about JPM

What is the current sentiment for JPM?

The short-term sentiment for JPM is currently Bearish because Price is pulling back from recent highs with consecutive strong red candles. The MACD has crossed below its signal line with an expanding negative histogram, and the RSI is declining towards the 50 level, indicating downward short-term momentum.. The long-term trend is classified as Bullish.

What are the key support levels for JPM?

StockDips.AI has identified key support levels for JPM at $308.25 and $288.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is JPM in a significant dip or a Value Dip right now?

JPM has a Value Score of 24/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.