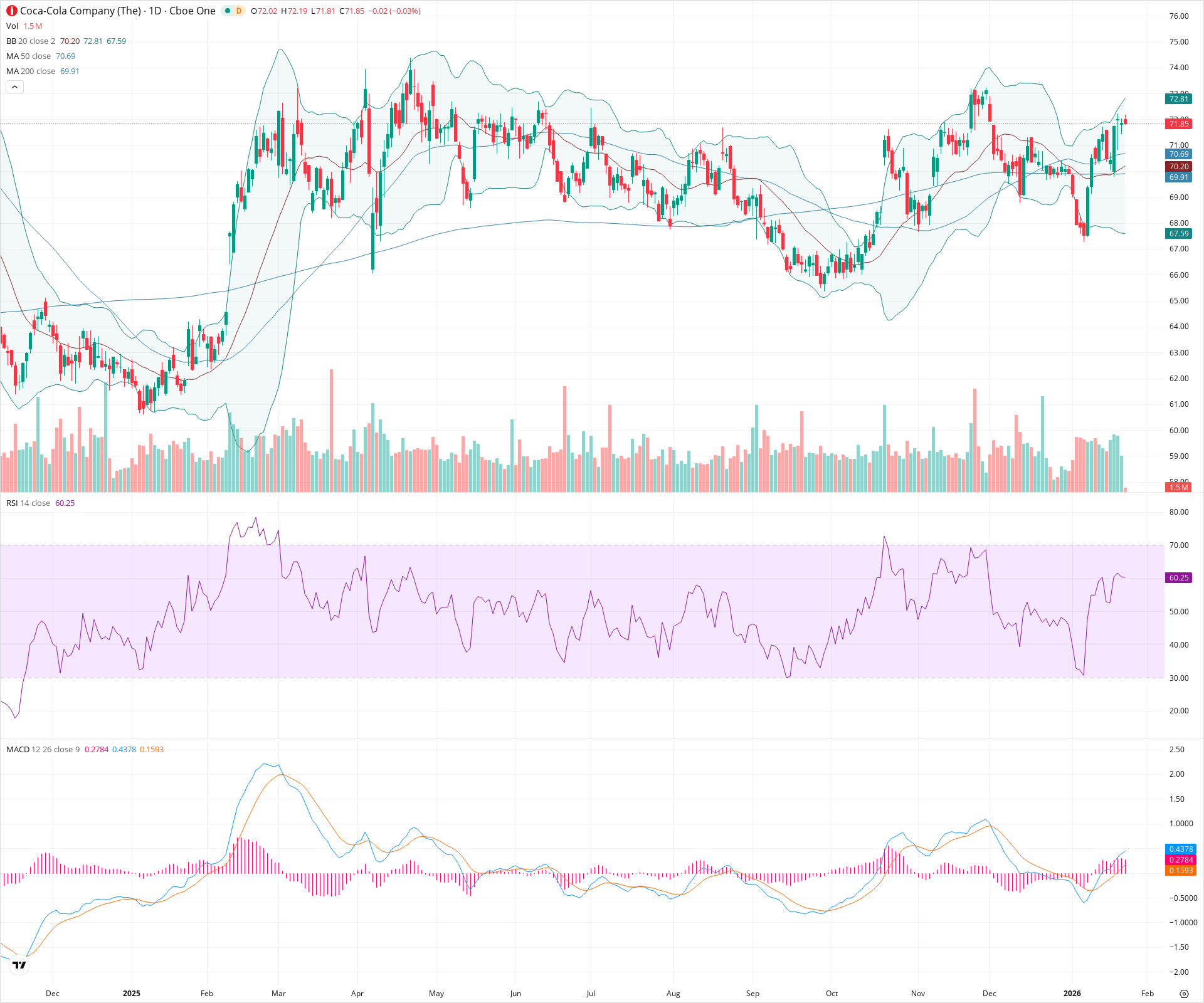

KO Daily Technical Analysis

Coca-Cola

World’s largest beverage company (Coke, Sprite, Fanta)

KO Technical Analysis Summary

The technical picture is bullish as the stock has successfully recovered from its late-year correction, now trading above all key moving averages (20, 50, and 200-day). Momentum is positive with the RSI around 60 and the MACD confirming the upward trend, suggesting buyers are in control. The price is currently testing the upper Bollinger Band; a sustained break above 72.80 could open the door for a retest of the summer highs near 74.00.

Included In Lists

Related Tickers of Interest

KO Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is trading above the 20-day SMA and holding well above the 50-day SMA. RSI is in a healthy bullish zone (60.25), and MACD lines are rising above the zero line with a positive histogram.

Long-term Sentiment (weeks to months): Bullish

The stock has reclaimed the 200-day SMA (69.91) and the 50-day SMA remains above the 200-day, maintaining a golden cross alignment. The long-term trend appears to be resuming after a Q4 correction.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:06:57.976Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $70.45 | $70.20 - $70.70 | Strong | Confluence zone containing the 20-day SMA (70.20) and the 50-day SMA (70.69). |

| $69.75 | $69.50 - $70.00 | Strong | Key psychological level backed by the 200-day SMA (69.91). |

| $66.50 | $66.00 - $67.00 | Weak | Recent swing lows and consolidation bottom from October/November. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $72.90 | $72.80 - $73.00 | Strong | Immediate resistance at the Upper Bollinger Band (72.81) and recent local highs. |

| $73.85 | $73.50 - $74.20 | Weak | Previous major swing highs visible from July/August. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Rounding Bottom / Recovery | Bullish | $74.00 | Since the October lows, the price action has formed a rounded recovery structure, consistently setting higher lows and reclaiming major moving averages. |

Frequently Asked Questions about KO

What is the current sentiment for KO?

The short-term sentiment for KO is currently Bullish because Price is trading above the 20-day SMA and holding well above the 50-day SMA. RSI is in a healthy bullish zone (60.25), and MACD lines are rising above the zero line with a positive histogram.. The long-term trend is classified as Bullish.

What are the key support levels for KO?

StockDips.AI has identified key support levels for KO at $70.45 and $69.75. These levels may represent potential accumulation zones where buying interest could emerge.

Is KO in a significant dip or a Value Dip right now?

KO has a Value Score of 31/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.