SBUX Daily Technical Analysis

Starbucks Corporation

Global coffeehouse chain offering beverages, food, and packaged goods through more than 35,000 locations worldwide.

SBUX Technical Analysis Summary

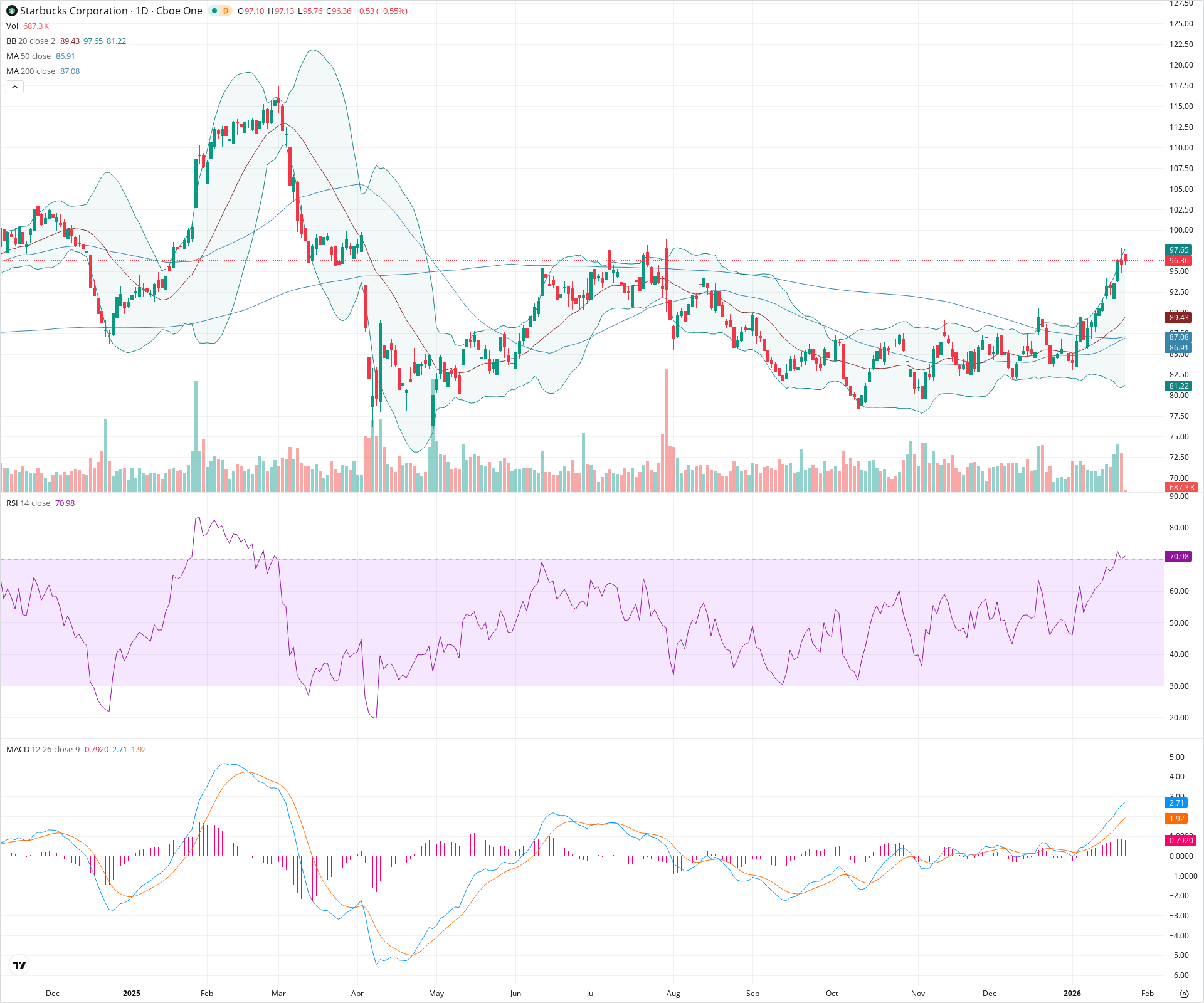

Starbucks shows a strong bullish reversal on the daily timeframe, having firmly broken above both the 50-day and 200-day Moving Averages. Momentum indicators like the MACD and RSI confirm this strength, though the RSI above 70 suggests the stock is currently overbought and may face short-term consolidation. The converging moving averages point toward an imminent Golden Cross, supporting a positive long-term outlook as long as price holds above the key 87.00 support cluster.

Included In Lists

Related Tickers of Interest

SBUX Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is in a strong uptrend, trading near the upper Bollinger Band with the RSI entering overbought territory (>70), indicating strong momentum.

Long-term Sentiment (weeks to months): Bullish

The stock has successfully reclaimed the 200-day SMA, and the 50-day SMA is curving upward to potentially cross the 200-day SMA (Golden Cross).

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:11:51.068Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $93.25 | $92.50 - $94.00 | Weak | Recent consolidation/breakout zone prior to the current leg up. |

| $87.00 | $86.91 - $87.08 | Strong | Confluence of the 50-day and 200-day SMAs. |

| $81.00 | $80.00 - $82.00 | Strong | Significant swing low area and lower Bollinger Band region. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $97.83 | $97.65 - $98.00 | Weak | Immediate resistance at the upper Bollinger Band and recent intraday highs. |

| $101.25 | $100.00 - $102.50 | Strong | Psychological level and historical resistance zone from earlier in the year. |

| $108.75 | $107.50 - $110.00 | Strong | Major swing high established in Q1. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bullish Breakout | Bullish | $102.00 | Price has broken out above the previous consolidation range (approx. 93-94) with expanding volume and momentum. |

| Strong | Approaching Golden Cross | Bullish | N/A | The 50-day SMA is rapidly rising and about to cross above the 200-day SMA, a classic long-term bullish signal. |

Frequently Asked Questions about SBUX

What is the current sentiment for SBUX?

The short-term sentiment for SBUX is currently Bullish because Price is in a strong uptrend, trading near the upper Bollinger Band with the RSI entering overbought territory (>70), indicating strong momentum.. The long-term trend is classified as Bullish.

What are the key support levels for SBUX?

StockDips.AI has identified key support levels for SBUX at $93.25 and $87.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is SBUX in a significant dip or a Value Dip right now?

SBUX has a Value Score of -1/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.