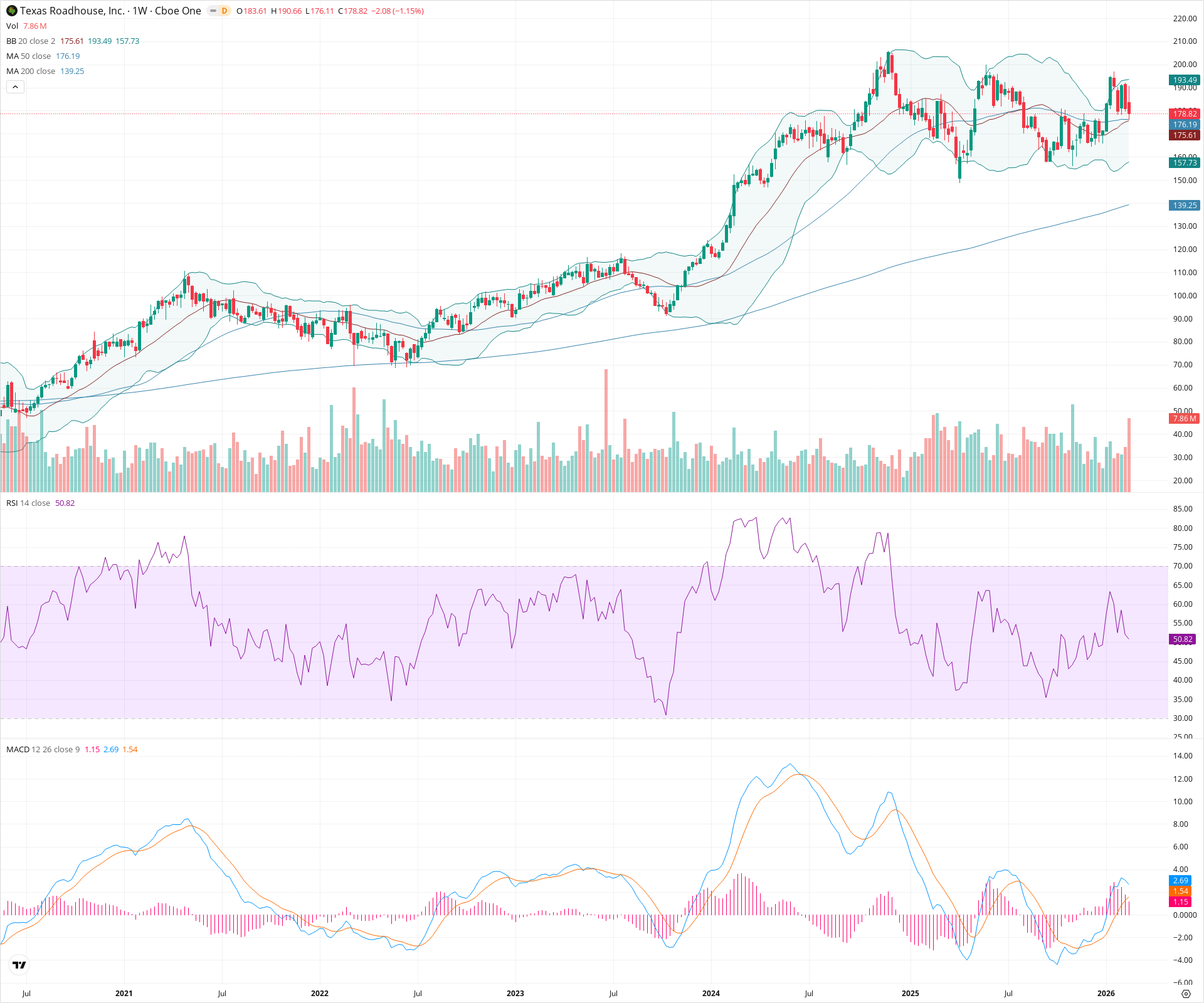

TXRH Weekly Technical Analysis

Texas Roadhouse Inc

Chain of family steakhouses known for hand-cut steaks and casual dining.

TXRH Technical Analysis Summary

TXRH remains in a dominant long-term uptrend, clearly supported by its rising 50-week and 200-week moving averages. In the short term, momentum has cooled as evidenced by a declining MACD and an RSI that has normalized to the 50 level after a run to new highs near 190. The broader bullish thesis remains intact as long as price holds above the primary support zone near the 50-week SMA.

Included In Lists

Related Tickers of Interest

TXRH Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is pulling back from recent highs near 190, with the MACD histogram turning negative and RSI retreating to the 50 level, indicating a pause or digestion of the recent rally.

Long-term Sentiment (weeks to months): Bullish

The long-term structure remains firmly intact, characterized by a series of higher highs and higher lows. Price continues to trade above both the rising 50-week and 200-week moving averages.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:37:19.936Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $176.00 | $175.00 - $177.00 | Strong | Confluence of recent swing lows and the rising 50-week SMA (176.19). |

| $158.50 | $157.00 - $160.00 | Strong | Major prior resistance zone that turned into support during the previous consolidation phase. |

| $140.50 | $139.00 - $142.00 | Strong | Area around the rising 200-week SMA (139.25) and previous structural lows. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $191.50 | $190.00 - $193.00 | Strong | Recent all-time high zone where the last major rally stalled. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Long-term Uptrend | Bullish | N/A | A sustained sequence of higher highs and higher lows starting from late 2022, bounded by rising moving averages. |

Frequently Asked Questions about TXRH

What is the current sentiment for TXRH?

The short-term sentiment for TXRH is currently Neutral because Price is pulling back from recent highs near 190, with the MACD histogram turning negative and RSI retreating to the 50 level, indicating a pause or digestion of the recent rally.. The long-term trend is classified as Bullish.

What are the key support levels for TXRH?

StockDips.AI has identified key support levels for TXRH at $176.00 and $158.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is TXRH in a significant dip or a Value Dip right now?

TXRH has a Value Score of 66/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.