AVGO Weekly Technical Analysis

Broadcom Inc

Designs semiconductors and enterprise software following its VMware acquisition.

AVGO Technical Analysis Summary

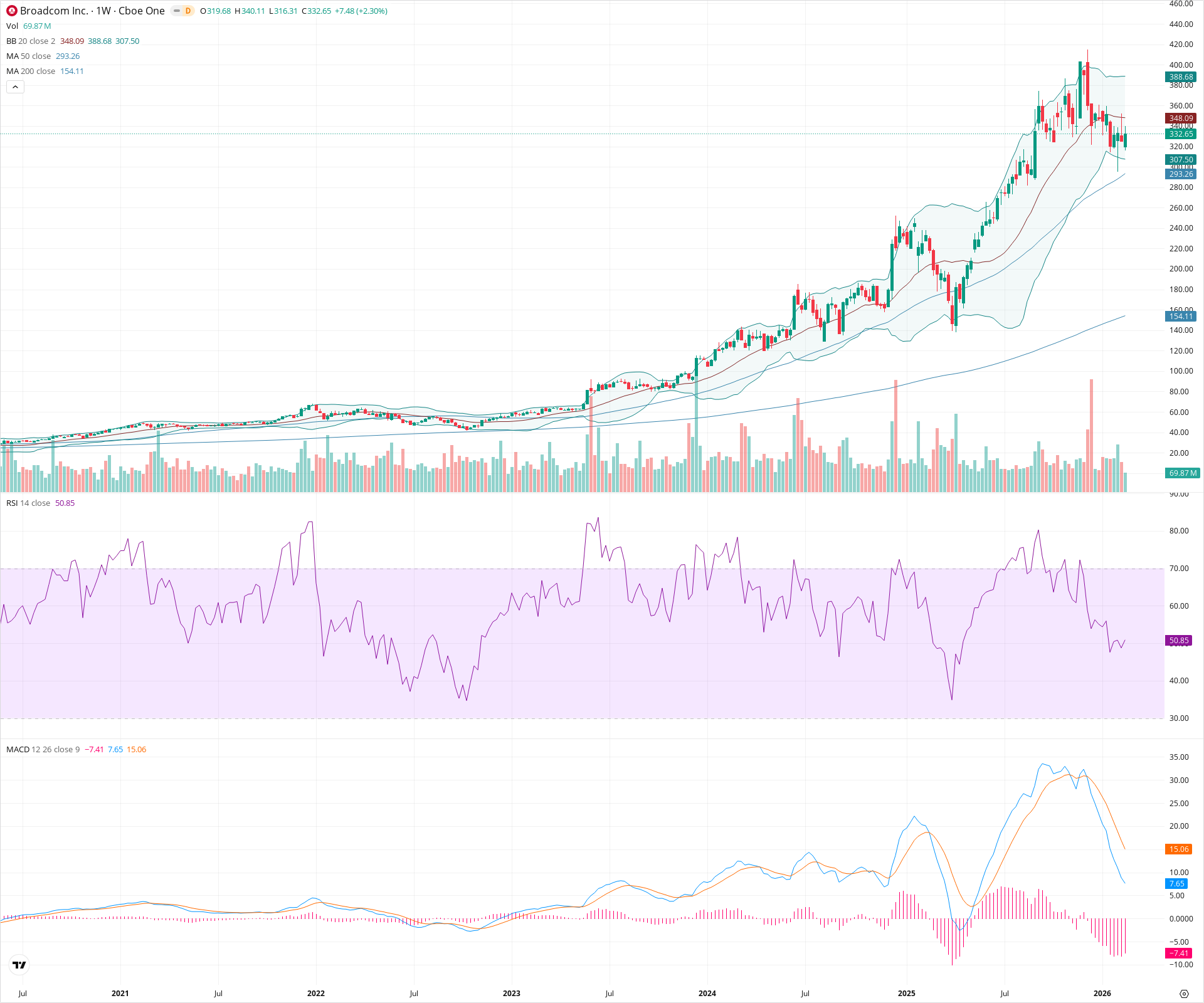

The weekly chart illustrates a strong long-term uptrend currently experiencing a significant intermediate-term correction. After a massive run-up, bearish momentum has taken over, confirmed by a break below the 20-week SMA and a negative MACD crossover. Long-term investors should watch for potential stabilization near the rising 50-week moving average in the 290-300 zone.

Included In Lists

Related Tickers of Interest

AVGO Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bearish

Price has broken below the 20-week moving average following a sharp decline from all-time highs. RSI has fallen rapidly to the 50 level, and the MACD shows a clear bearish crossover with expanding negative histogram, confirming downward momentum.

Long-term Sentiment (weeks to months): Bullish

The broader multi-year trend remains firmly upward. The price is still trading significantly above the rising 50-week and 200-week moving averages, suggesting the current action is a structural pullback within a larger bull market.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:33:16.625Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $297.50 | $290.00 - $305.00 | Strong | Confluence of the rising 50-week moving average and prior consolidation zones. |

| $250.00 | $240.00 - $260.00 | Strong | Major prior breakout and consolidation area from late 2024. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $355.00 | $345.00 - $365.00 | Strong | The 20-week moving average (currently near 348) and the lower bound of recent upper consolidation before the breakdown. |

| $430.00 | $420.00 - $440.00 | Strong | Recent all-time high area. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Mean Reversion / Correction | Bearish | $295.00 | After a parabolic, multi-month run stretching far above long-term moving averages, the price is undergoing a sharp reversion towards the 50-week moving average. |

Frequently Asked Questions about AVGO

What is the current sentiment for AVGO?

The short-term sentiment for AVGO is currently Bearish because Price has broken below the 20-week moving average following a sharp decline from all-time highs. RSI has fallen rapidly to the 50 level, and the MACD shows a clear bearish crossover with expanding negative histogram, confirming downward momentum.. The long-term trend is classified as Bullish.

What are the key support levels for AVGO?

StockDips.AI has identified key support levels for AVGO at $297.50 and $250.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is AVGO in a significant dip or a Value Dip right now?

AVGO has a Value Score of 41/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.