PEP Weekly Technical Analysis

PepsiCo

Global food & beverage giant (Pepsi, Gatorade, Lays, Doritos)

PEP Technical Analysis Summary

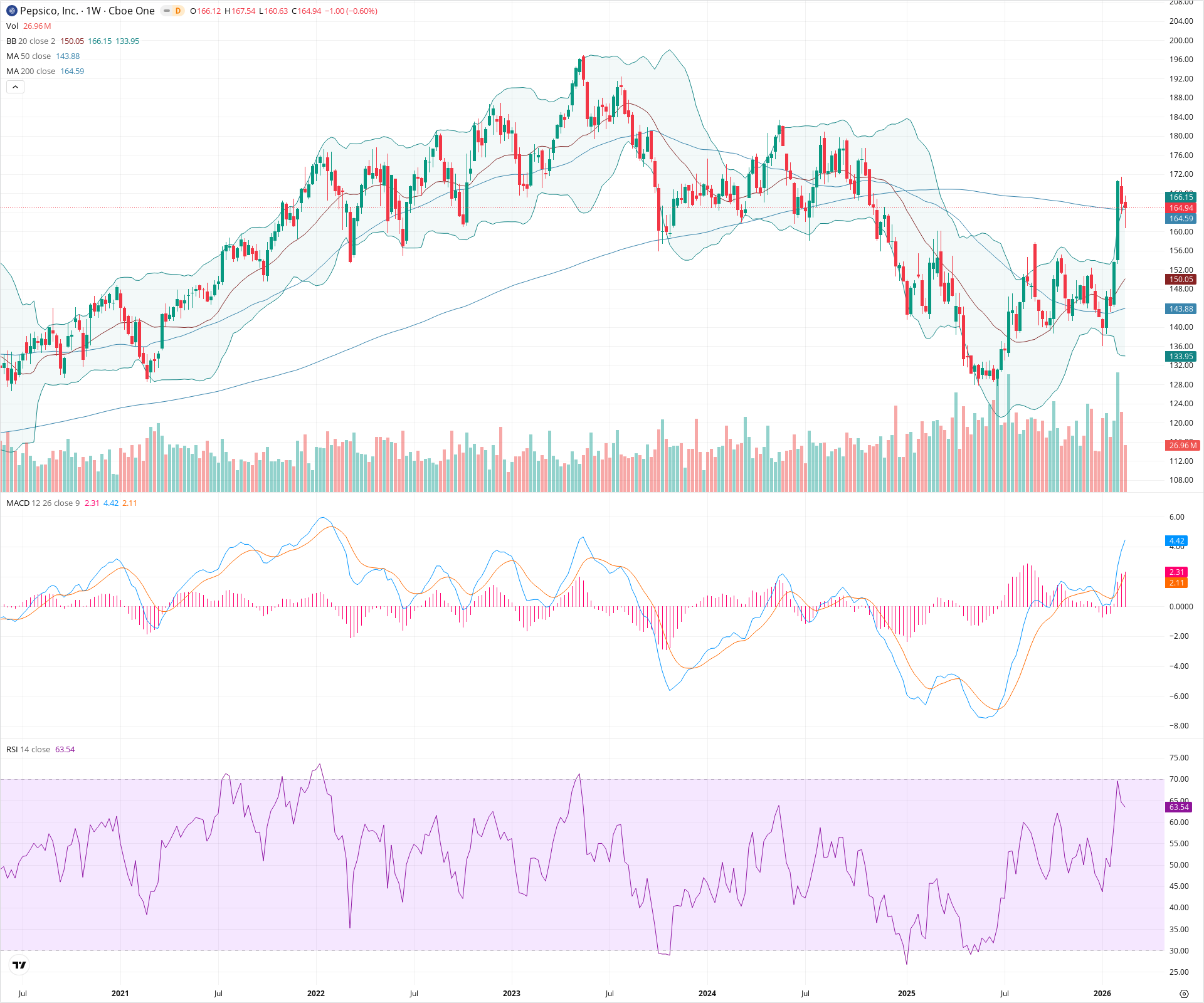

PEP has initiated a forceful short-term rally off a major double bottom support zone near 156, bolstered by a clear bullish weekly MACD crossover. The stock is currently challenging a significant band of overhead resistance around 165-168, which includes the 50-week moving average. While short-term momentum is decidedly positive, a sustained breakout above the 176 structural resistance is required to confirm an end to the broader corrective phase and a resumption of the primary multi-year uptrend.

Included In Lists

Related Tickers of Interest

PEP Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price has formed a sharp recovery from the 156 support zone, breaking above the 20-week moving average. This bounce is confirmed by a bullish MACD crossover deep in negative territory and a steeply rising RSI.

Long-term Sentiment (weeks to months): Neutral

The stock remains in a broad, multi-month corrective structure, making lower highs since the 2023 peak. However, it continues to hold structural support well above the long-term rising 200-week SMA, indicating a prolonged consolidation rather than a secular bear trend.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:36:01.725Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $158.00 | $156.00 - $160.00 | Strong | Recent major swing low and origin of the current sharp rally; forms the base of a potential double bottom. |

| $145.50 | $143.00 - $148.00 | Strong | Long-term historical consolidation zone aligning with the rising 200-week SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $166.50 | $165.00 - $168.00 | Strong | Immediate overhead confluence zone including the 50-week SMA, the upper Bollinger Band, and previous minor consolidation. |

| $178.00 | $176.00 - $180.00 | Strong | Major structural lower high from mid-2023; a critical level to clear to signal a long-term trend reversal. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Double Bottom | Bullish | $196.00 | Price has found significant support twice in the 156-158 area over several months, with the most recent test resulting in a strong bullish reversal and MACD crossover. |

Frequently Asked Questions about PEP

What is the current sentiment for PEP?

The short-term sentiment for PEP is currently Bullish because Price has formed a sharp recovery from the 156 support zone, breaking above the 20-week moving average. This bounce is confirmed by a bullish MACD crossover deep in negative territory and a steeply rising RSI.. The long-term trend is classified as Neutral.

What are the key support levels for PEP?

StockDips.AI has identified key support levels for PEP at $158.00 and $145.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is PEP in a significant dip or a Value Dip right now?

PEP has a Value Score of 75/100. It is currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.