PG Weekly Technical Analysis

Procter & Gamble

Consumer staples leader (Tide, Pampers, Gillette, Olay)

PG Technical Analysis Summary

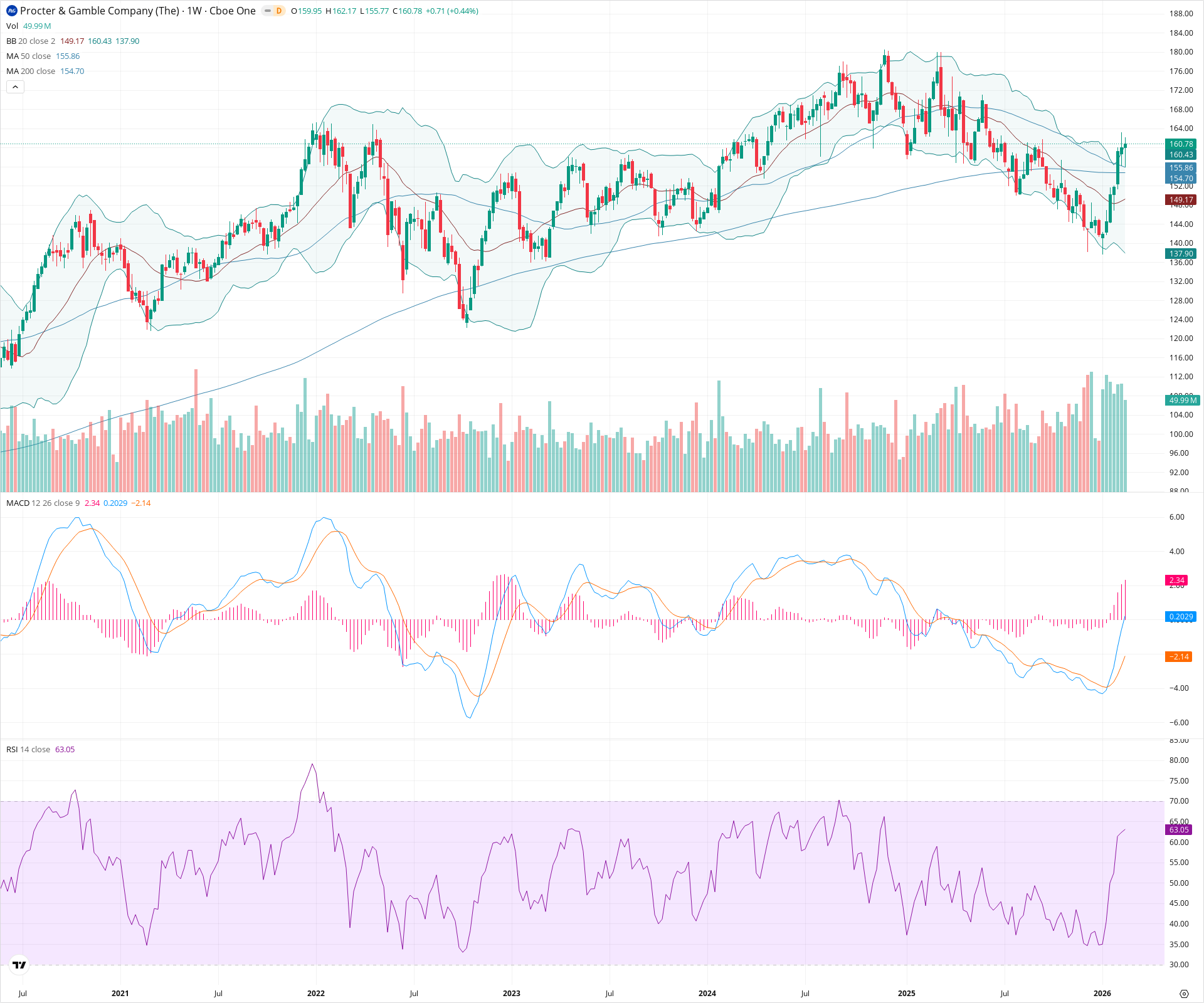

PG is currently demonstrating robust long-term technical strength after breaking out from a massive multi-year consolidation base. The primary trend is distinctly bullish, confirmed by price action holding firmly above upward-sloping major moving averages and strong momentum indicators like the MACD. While near-term price is approaching prior structural highs around 164-165, the overarching technical picture remains highly constructive for long-term investors as long as support near the 155 breakout level is maintained.

Included In Lists

Related Tickers of Interest

PG Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is exhibiting strong upward momentum, riding the upper Bollinger Band, supported by a rising RSI and an expanding positive MACD histogram.

Long-term Sentiment (weeks to months): Bullish

The stock has broken out of a significant multi-year consolidation phase, with price positioned above rising 50-week and 200-week SMAs, confirming a strong primary uptrend.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:34:25.414Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $155.50 | $154.50 - $156.50 | Strong | Key confluence zone consisting of prior resistance turned support, alongside the current levels of both the 50-week and 200-week SMAs. |

| $149.00 | $148.00 - $150.00 | Weak | Recent consolidation area and the approximate location of the rising 20-week SMA. |

| $138.50 | $137.00 - $140.00 | Strong | Major swing lows from late 2023 that served as a significant base before the current rally. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $164.50 | $163.50 - $165.50 | Strong | Multi-year structural highs established in early 2022; the primary visible overhead resistance. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Multi-Year Base Breakout | Bullish | N/A | Price has decisively broken above a massive, multi-year consolidation base that formed between roughly 125 and 156, indicating a resumption of the long-term structural uptrend. |

Frequently Asked Questions about PG

What is the current sentiment for PG?

The short-term sentiment for PG is currently Bullish because Price is exhibiting strong upward momentum, riding the upper Bollinger Band, supported by a rising RSI and an expanding positive MACD histogram.. The long-term trend is classified as Bullish.

What are the key support levels for PG?

StockDips.AI has identified key support levels for PG at $155.50 and $149.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is PG in a significant dip or a Value Dip right now?

PG has a Value Score of 41/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.