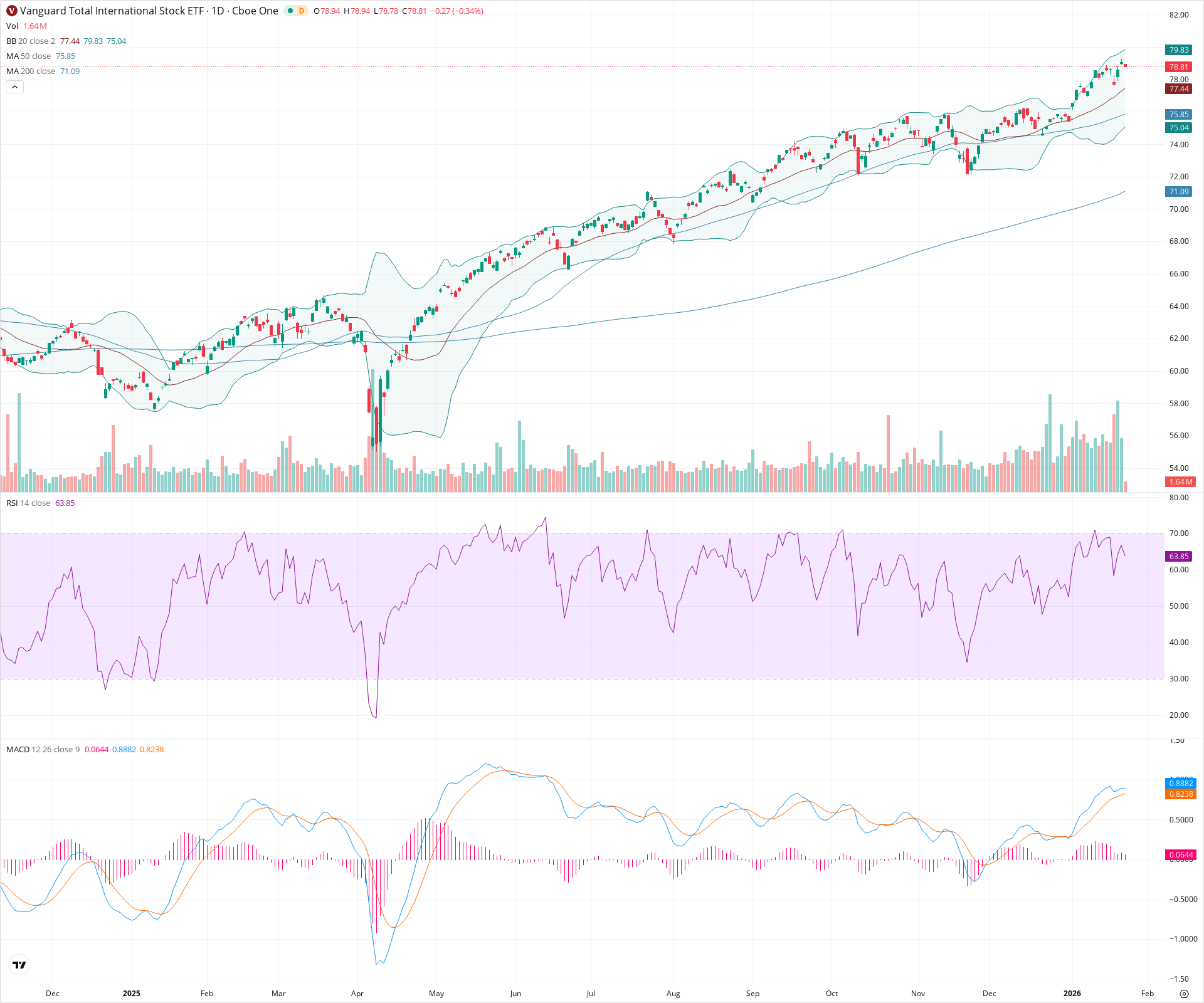

VXUS Daily Technical Analysis

International Stock Index

Vanguard Total International Stock ETF - Covers thousands of companies across developed and emerging markets outside the U.S.

VXUS Technical Analysis Summary

VXUS exhibits a strong long-term bullish trend, trading comfortably above all key moving averages with consistent upward momentum. While the short-term view shows a minor pullback from the upper Bollinger Band and recent highs near 80.50, the technical structure remains healthy with the RSI resetting from overbought territory. The MACD remains positive, confirming the underlying trend, though the histogram suggests a momentary pause in momentum.

Included In Lists

Related Tickers of Interest

VXUS Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price remains above the rising 20-day SMA (77.44) and the uptrend structure is intact despite a minor pullback from recent highs.

Long-term Sentiment (weeks to months): Bullish

The stock is trading well above the rising 50-day (75.85) and 200-day (71.09) moving averages, with a clear sequence of higher highs and higher lows over the visible period.

Report Metadata

- Timeframe: daily

- Generated at: 2026-01-23T15:01:10.683Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $77.45 | $77.40 - $77.50 | Strong | Confluence of the 20-day SMA and the middle Bollinger Band. |

| $75.43 | $75.00 - $75.85 | Strong | Zone surrounding the 50-day SMA and previous consolidation support. |

| $71.50 | $71.00 - $72.00 | Weak | Long-term support near the 200-day SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $80.15 | $79.80 - $80.50 | Strong | Recent swing high combined with the upper Bollinger Band resistance. |

| $82.25 | $82.00 - $82.50 | Weak | Psychological extension level above current highs. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Ascending Channel | Bullish | N/A | Price has been trending upwards within a defined channel characterized by higher highs and higher lows since mid-2025. |

| Weak | Minor Pullback | Neutral | N/A | Short-term consolidation or pullback following a touch of the upper Bollinger Band, allowing RSI to cool off from near-overbought levels. |

Frequently Asked Questions about VXUS

What is the current sentiment for VXUS?

The short-term sentiment for VXUS is currently Bullish because Price remains above the rising 20-day SMA (77.44) and the uptrend structure is intact despite a minor pullback from recent highs.. The long-term trend is classified as Bullish.

What are the key support levels for VXUS?

StockDips.AI has identified key support levels for VXUS at $77.45 and $75.43. These levels may represent potential accumulation zones where buying interest could emerge.

Is VXUS in a significant dip or a Value Dip right now?

VXUS has a Value Score of 34/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.