EEM Daily Technical Analysis

Emerging Markets ETF

iShares MSCI Exchange-Traded Fund designed to track the performance of large- and mid-cap stocks across emerging market countries, including China, Taiwan, India, Brazil, and South Africa. Often used as a macro indicator for global risk appetite and emerging-market sentiment.

EEM Technical Analysis Summary

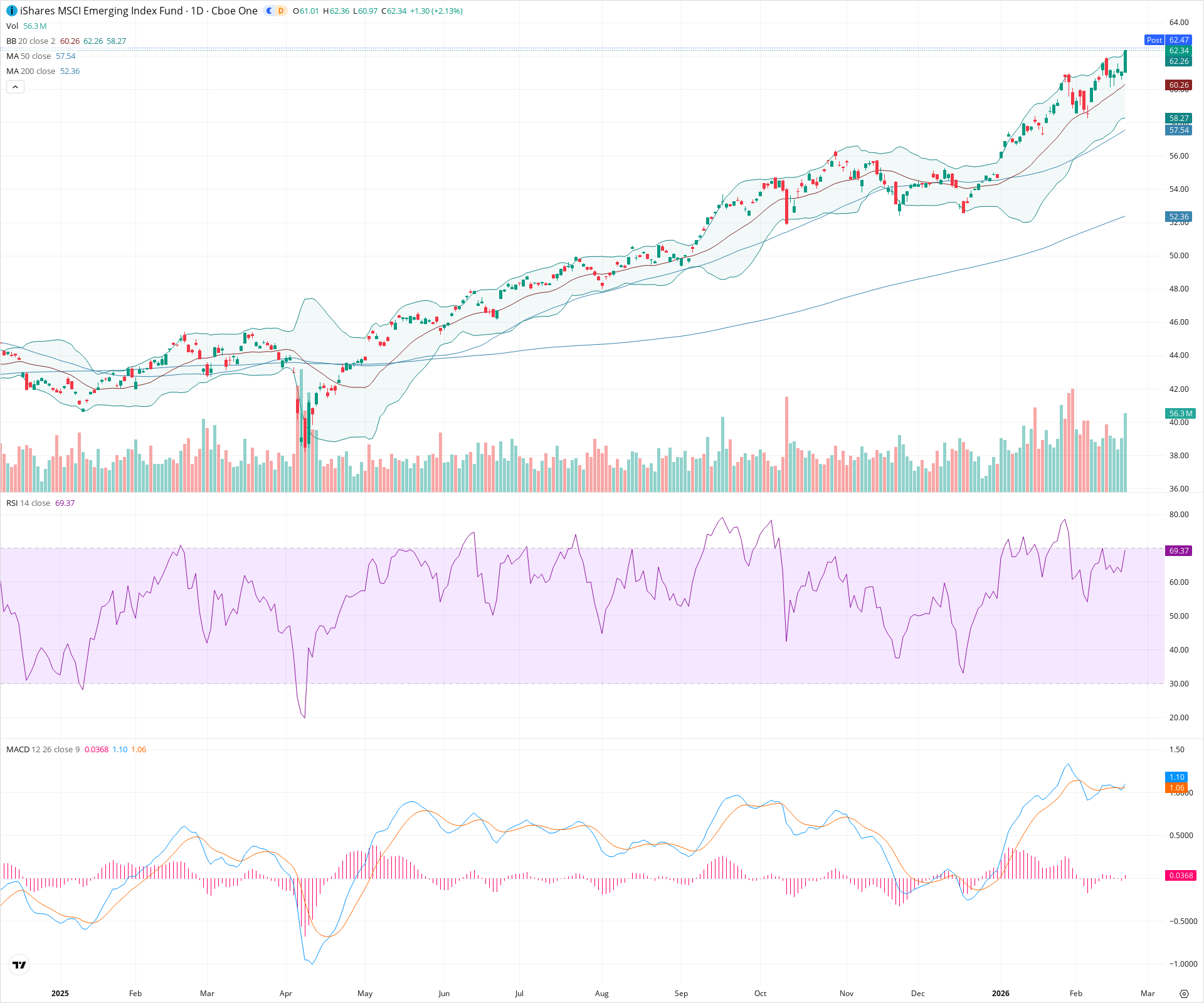

EEM is exhibiting a strong bullish trend across all timeframes visible, confirmed by the price trading above rising 20, 50, and 200-day SMAs. A fresh breakout above the 60.50 resistance level is supported by rising momentum in the MACD and RSI, though the RSI approaching 70 suggests monitoring for short-term overextension. The close above the upper Bollinger Band indicates high volatility and strong buying pressure.

Included In Lists

Related Tickers of Interest

EEM Daily Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is breaking out to new highs with a strong bullish candle closing above the upper Bollinger Band. RSI is rising (69.37) indicating strong momentum without being extremely overbought yet. MACD has just executed a bullish crossover above the signal line.

Long-term Sentiment (weeks to months): Bullish

The chart shows a robust long-term uptrend characterized by a 'stack' of rising moving averages (20 > 50 > 200). Price is well above the rising 200-day SMA, confirming the primary trend direction.

Report Metadata

- Timeframe: daily

- Generated at: 2026-02-20T22:06:29.305Z

- Model: gemini-3-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $60.40 | $60.00 - $60.80 | Strong | Former resistance zone from the recent consolidation pattern, now expected to act as support. |

| $57.77 | $57.54 - $58.00 | Strong | Confluence of the 50-day SMA (green line) and recent swing lows. |

| $52.93 | $52.36 - $53.50 | Weak | Major trend support near the 200-day SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $62.42 | $62.36 - $62.47 | Weak | Immediate intraday high and post-market level acting as short-term ceiling. |

| $64.50 | $64.00 - $65.00 | Weak | Psychological round number targets and upper extension of the trend channel. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Bullish Breakout | Bullish | $65.00 | Price has cleared a multi-week consolidation range (approx. 56.00-60.50) and is closing at fresh highs. |

| Strong | Golden Cross Alignment | Bullish | N/A | While the cross itself is historical, the maintained parallel upward slope of the 50 SMA above the 200 SMA confirms a healthy, sustained trend. |

Frequently Asked Questions about EEM

What is the current sentiment for EEM?

The short-term sentiment for EEM is currently Bullish because Price is breaking out to new highs with a strong bullish candle closing above the upper Bollinger Band. RSI is rising (69.37) indicating strong momentum without being extremely overbought yet. MACD has just executed a bullish crossover above the signal line.. The long-term trend is classified as Bullish.

What are the key support levels for EEM?

StockDips.AI has identified key support levels for EEM at $60.40 and $57.77. These levels may represent potential accumulation zones where buying interest could emerge.

Is EEM in a significant dip or a Value Dip right now?

EEM has a Value Score of 4/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.