IWM Weekly Technical Analysis

US Small Cap Index (2000)

iShares Russell 2000 ETF - Tracks the index of 2000 small U.S. companies representing the small-cap segment.

IWM Technical Analysis Summary

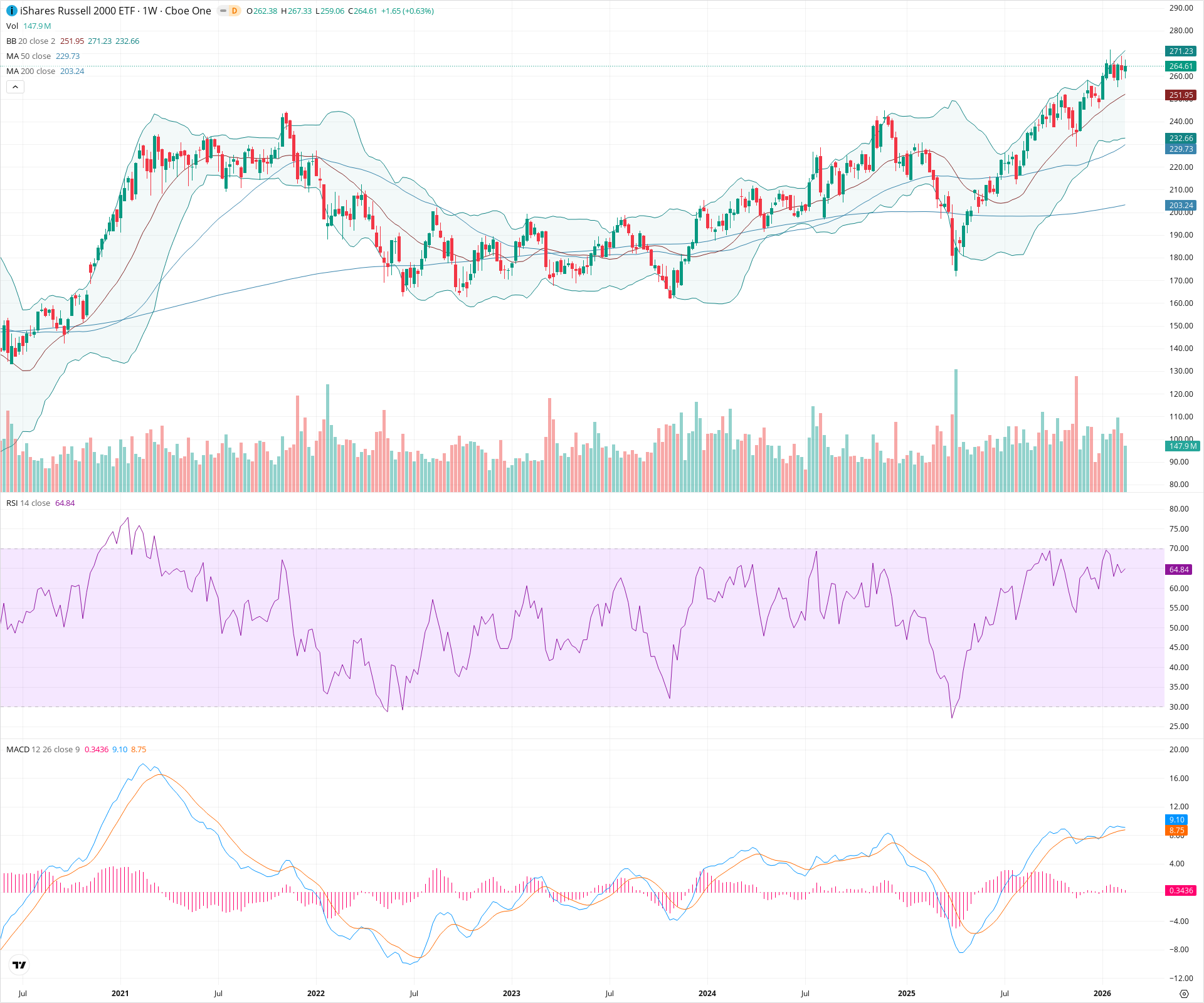

The weekly chart presents a highly constructive long-term picture following a decisive breakout from a multi-year consolidation base. The primary trend is firmly bullish, supported by positively aligned and rising 50-week and 200-week moving averages, alongside strong momentum indicators. While the current price is somewhat extended in the short term, the overall structure suggests continued upward bias, with any pullbacks toward the 230-240 zone likely presenting healthy consolidation within the broader uptrend.

Included In Lists

Related Tickers of Interest

IWM Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price is making higher highs and higher lows, trending near the upper Bollinger Band, with RSI holding strong in bullish territory (around 65) and a positive MACD.

Long-term Sentiment (weeks to months): Bullish

The chart shows a powerful breakout from a massive multi-year base. The 50-week SMA is trending sharply upwards above the rising 200-week SMA, confirming a strong primary uptrend.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:02:00.221Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $251.50 | $248.00 - $255.00 | Weak | Immediate dynamic support at the 20-week SMA (middle Bollinger Band) and recent minor swing lows. |

| $235.00 | $230.00 - $240.00 | Strong | Major prior resistance zone turned structural support, converging with the rising 50-week SMA. |

| $200.00 | $195.00 - $205.00 | Strong | Long-term base support area and current location of the 200-week SMA. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $269.50 | $267.00 - $272.00 | Weak | Immediate resistance near the recent swing high and psychological whole number levels. |

| $282.50 | $280.00 - $285.00 | Weak | Next potential psychological resistance zone given the lack of recent historical price action above current levels. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Multi-Year Base Breakout | Bullish | N/A | Price definitively broke out of a prolonged consolidation range (roughly 160 to 210) that persisted from 2022 into 2024, initiating a new secular trend. |

| Strong | Primary Uptrend | Bullish | N/A | A steep and consistent sequence of higher highs and higher lows since late 2024, characterized by riding the upper Bollinger Band. |

Frequently Asked Questions about IWM

What is the current sentiment for IWM?

The short-term sentiment for IWM is currently Bullish because Price is making higher highs and higher lows, trending near the upper Bollinger Band, with RSI holding strong in bullish territory (around 65) and a positive MACD.. The long-term trend is classified as Bullish.

What are the key support levels for IWM?

StockDips.AI has identified key support levels for IWM at $251.50 and $235.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is IWM in a significant dip or a Value Dip right now?

IWM has a Value Score of 49/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.