QQQ Weekly Technical Analysis

Nasdaq-100 Index (Tech)

Invesco QQQ - Follows the Nasdaq-100 index, heavily weighted toward major technology companies.

QQQ Technical Analysis Summary

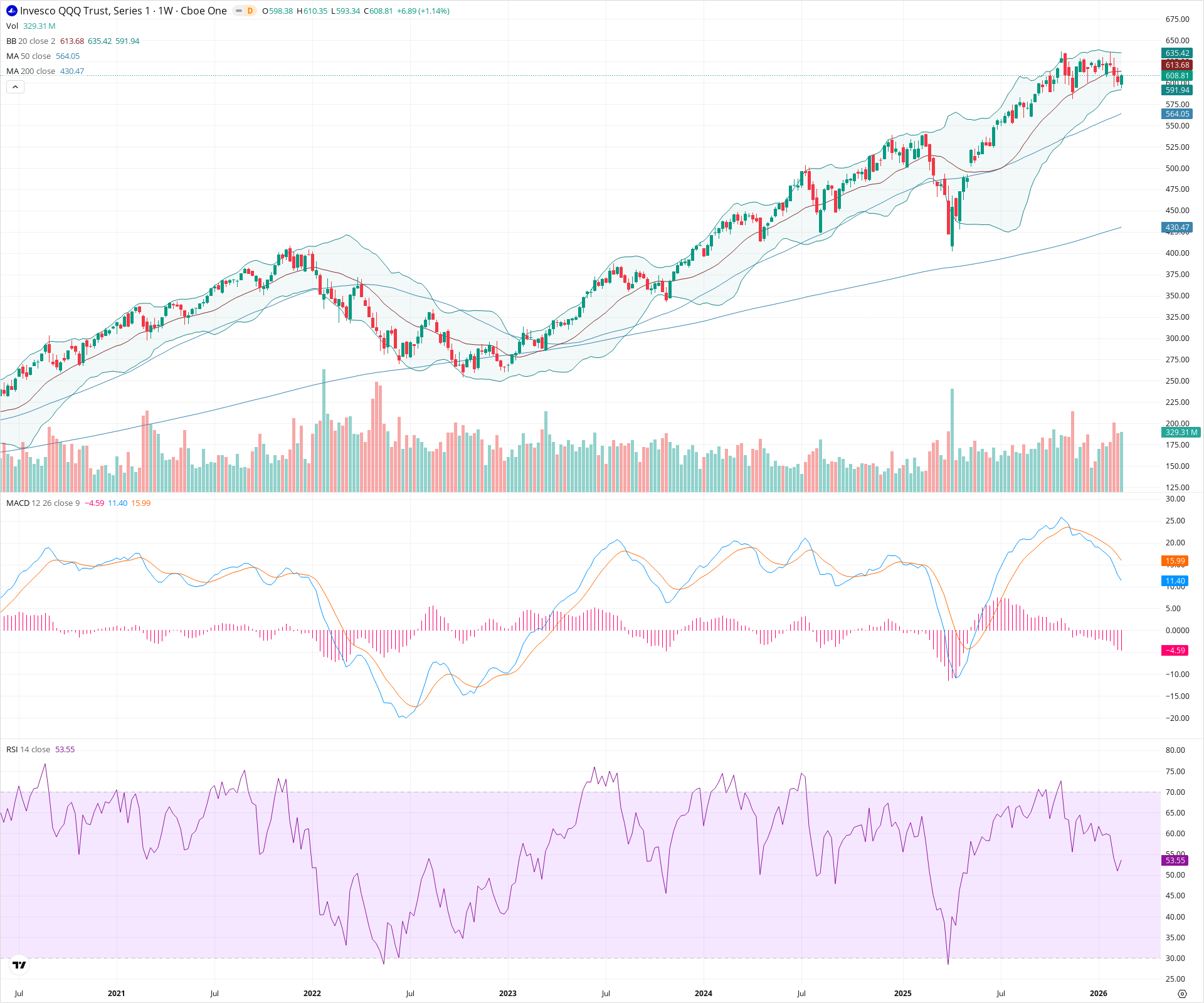

The weekly technical posture remains resolutely bullish from a macro perspective, with price action decisively above key upward-sloping moving averages. However, the short-term picture shows momentum cooling off, as evidenced by the MACD crossing downwards and the RSI receding from overbought territory. This current high-level consolidation appears to be a healthy pause within the larger structural uptrend, provided price remains above primary support near the 50-week SMA.

Included In Lists

Related Tickers of Interest

QQQ Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Neutral

Price is consolidating near its recent highs and hovering around the 20-week SMA. The weekly MACD has experienced a bearish crossover and the histogram is negative, indicating slowing near-term momentum, but primary uptrend structure has not been broken.

Long-term Sentiment (weeks to months): Bullish

The macro price structure shows a clear, multi-year sequence of higher highs and higher lows. Price remains positioned well above the rising 50-week and 200-week Simple Moving Averages, confirming a strong underlying trend.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:02:09.877Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $595.00 | $590.00 - $600.00 | Weak | Immediate short-term support zone consisting of recent swing lows during the current consolidation phase. |

| $562.50 | $550.00 - $575.00 | Strong | Major structural support zone. This area previously acted as resistance before a breakout and currently aligns closely with the rising 50-week SMA. |

| $462.50 | $450.00 - $475.00 | Strong | Significant prior macro consolidation zone and structural swing low before the most recent major leg higher. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $642.50 | $635.00 - $650.00 | Strong | The overhead supply zone marked by the recent all-time high peaks. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | High-Level Consolidation | Neutral | N/A | Following an extended parabolic advance, the price is currently trading sideways to slightly lower in a narrow range. This represents a period of digestion and profit-taking near all-time highs. |

Frequently Asked Questions about QQQ

What is the current sentiment for QQQ?

The short-term sentiment for QQQ is currently Neutral because Price is consolidating near its recent highs and hovering around the 20-week SMA. The weekly MACD has experienced a bearish crossover and the histogram is negative, indicating slowing near-term momentum, but primary uptrend structure has not been broken.. The long-term trend is classified as Bullish.

What are the key support levels for QQQ?

StockDips.AI has identified key support levels for QQQ at $595.00 and $562.50. These levels may represent potential accumulation zones where buying interest could emerge.

Is QQQ in a significant dip or a Value Dip right now?

QQQ has a Value Score of 36/100. It is not currently flagged as a significant dip in the Top Dips list. It is not listed as a Value Dip because the long-term sentiment or value-score threshold does not qualify.

View the full interactive analysis on StockDips.AI.