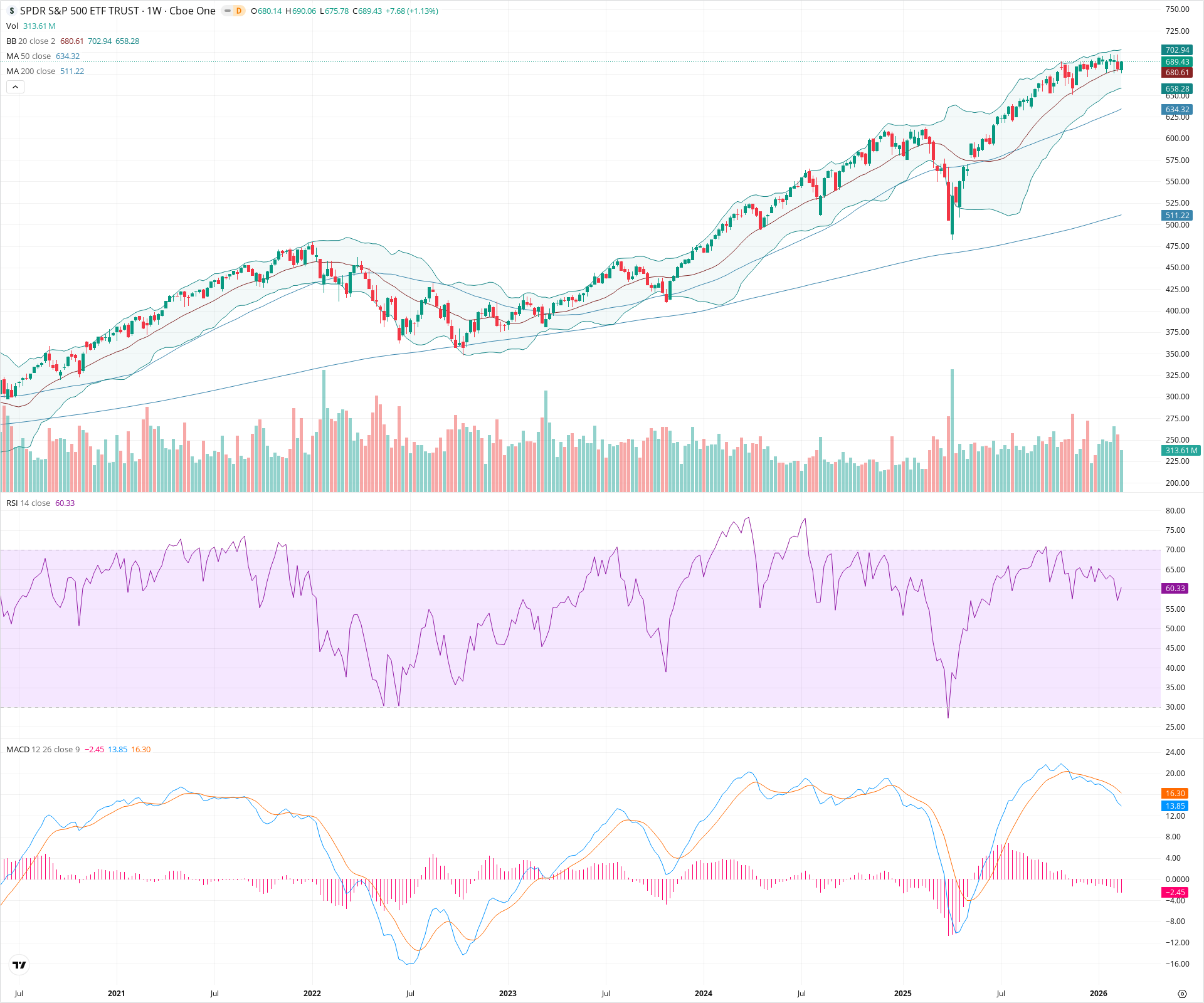

SPY Weekly Technical Analysis

S&P 500 Index

SPDR S&P 500 ETF - Tracks the S&P 500 index of the largest U.S. companies and serves as a core benchmark for the U.S. market.

SPY Technical Analysis Summary

SPY remains in a dominant, long-term weekly uptrend, characterized by price action well above rising 50-week and 200-week moving averages. While a recent bearish MACD crossover suggests a potential slowing of near-term momentum or a period of consolidation, the overarching structural trend remains firmly bullish. Long-term investors should watch the 50-week SMA as a key barometer for continued trend health.

Included In Lists

Related Tickers of Interest

SPY Weekly Chart

Sentiment

Short-term Sentiment (days to weeks): Bullish

Price remains in a steady sequence of higher highs and higher lows, holding above the rising 20-week SMA. While MACD shows a bearish crossover indicating slowing momentum, price structure has not broken down.

Long-term Sentiment (weeks to months): Bullish

The chart displays a robust, multi-year uptrend. Price is trading significantly above both the 50-week and 200-week SMAs, which are sloping upwards, confirming sustained long-term buying pressure.

Report Metadata

- Timeframe: weekly

- Generated at: 2026-02-21T18:01:55.008Z

- Model: gemini-3.1-pro-preview

Support Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $677.50 | $670.00 - $685.00 | Weak | Immediate support zone aligned with the rising 20-week SMA and recent minor swing lows. |

| $640.00 | $630.00 - $650.00 | Strong | Major structural support zone converging with the 50-week SMA and a significant prior period of consolidation. |

Resistance Price Levels

| Level | Range | Strength | Notes |

|---|---|---|---|

| $697.50 | $690.00 - $705.00 | Weak | Current all-time high territory and the psychological 700 level. Lacks historical touches to be considered strong. |

Potential Chart Patterns in Formation

| Strength | Pattern | Signal | Target | Details |

|---|---|---|---|---|

| Strong | Long-term Ascending Trend | Bullish | N/A | A sustained, multi-year sequence of higher highs and higher lows consistently riding above key moving averages. |

Frequently Asked Questions about SPY

What is the current sentiment for SPY?

The short-term sentiment for SPY is currently Bullish because Price remains in a steady sequence of higher highs and higher lows, holding above the rising 20-week SMA. While MACD shows a bearish crossover indicating slowing momentum, price structure has not broken down.. The long-term trend is classified as Bullish.

What are the key support levels for SPY?

StockDips.AI has identified key support levels for SPY at $677.50 and $640.00. These levels may represent potential accumulation zones where buying interest could emerge.

Is SPY in a significant dip or a Value Dip right now?

SPY has a Value Score of 79/100. It is currently flagged as a significant dip in the Top Dips list. It is also listed as a Value Dip because long-term sentiment is bullish.

View the full interactive analysis on StockDips.AI.